Will AUDJPY rebound?FX_IDC:AUDJPY had recently corrected lower, but continues to trade above a broken downside resistance line. Will we see a push back up anytime soon?

Let's dig in...

MARKETSCOM:AUDJPY

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Aud

Nasdaq 100 set for 25k?The Nasdaq 100 is in a technical bull market, having rebounded 20% from its cycle low. While the risk remains that this is simply a 'bear market bounce' that could sucker punch bulls, I believe bulls have got this and we could be headed for 25k.

Matt Simpson, Market Analyst at City Index and Forex.com

AUDJPY, our risk on/off monitor, is near a key resistance areaAUDJPY has been on a good run lately. The driving force behind it was the improved market sentiment due to the calming moment in the tariff wars. Can this be sustained?

Let's look at the technical picture of AUDJPY.

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Australian CPI Surprise: What It Means for the RBA & AUD/USDMatt Simpson breaks down the latest Australian inflation data and what it could mean for the Reserve Bank of Australia’s next move. Plus, we dive into the AUD/USD, AUD/CAD, GBP/AUD and EUR/AUD charts for key technical setups traders need to watch right now.

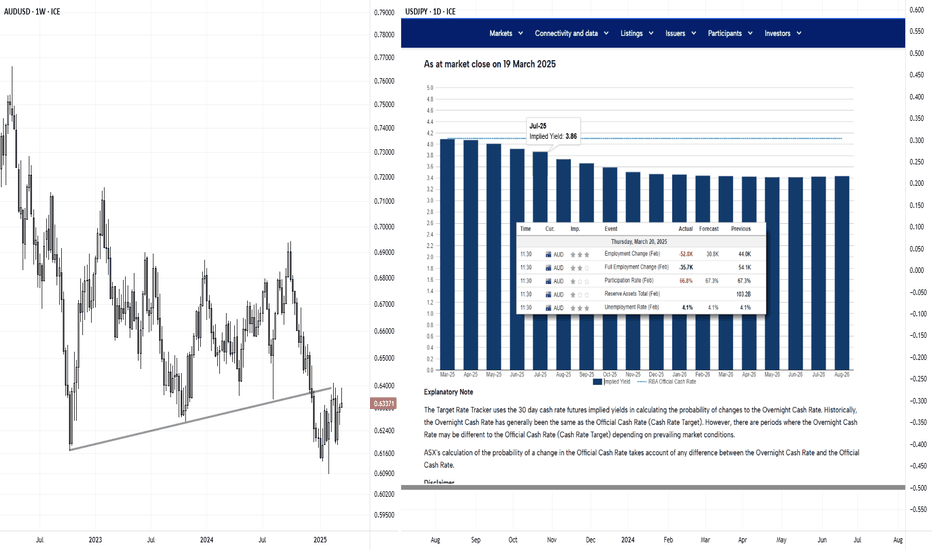

Why the Weak AU Jobs Report Might Not Force the RBA's HandAustralia's employment report for February delivered a surprising set of weak figures. Understandably, markets reacted by pricing in another RBA cut to arrive sooner than later. But if we dig a little deeper, an April or May cut may still not be a given.

Matt Simpson, Market Analyst at City Index and Forex.com

JPY remains under selling pressureThe Japanese government is currently enjoying the weaker yen, as it helps boost the economy. However, this is only a short-term solution, as eventually, people's anger about rapidly rising prices might overshadow that government's positivity.

#audjpy EASYMARKETS:AUDJPY FX_IDC:AUDJPY

Disclaimer:

easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURAUD continues to flirt with the highest point of 2024We mentioned this pair last week and told you to keep an eye on the highest point of 2024. And there we are, MARKETSCOM:EURAUD is flirting with that area. If we continue to see the rate struggling to remain above that hurdle, there might be a chance for a slight retracement.

What do you think?

Let's dig in!

FX_IDC:EURAUD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

EURAUD, EURNZD and AUDNZD - Quick technical pieceWe are seeing strong move in the euro just before the ECB rate decision on Thursday. However, let's not forget that we will get some action from the RBA and RBNZ in the first days of April. MARKETSCOM:EURAUD and MARKETSCOM:EURNZD are at key resistance areas, which could be interesting for the sellers. That said, we have not received any reversal signal yet, so the bears need to wait for a bit.

Let's dig into the technicals.

FX_IDC:EURAUD

FX_IDC:EURNZD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

AUD/NZD could be veering towards a breakoutThe RBNZ just delivered their third 50bp cut in a row, and they have left the door open for further easing this year. And given I expect the RBNZ's cash rate to remain beneath the RBA's for the remainder of the year, it could pave the way for a bullish breakout on AUD/NZD.

Matt Simpson, Market Analyst at City Index and Forex.com

The RBA just cut by 25bp: Instant ViewThe RBA have just cut their cash rate for the first time since late 2020. Using their monetary policy statement and updated forecast, I provide my instant high-level view of what this could mean fir future policy - with an update to my AUD/USD outlook thrown in for good measure.

Matt Simpson, Market Analyst at City Index and Forex.com

Mastering AUDUSD: Key Trading Zones Revealed for Optimal EntriesGreetings, traders! Welcome to this AUDUSDmarket analysis, where we focus on identifying higher-probability trading opportunities.

In this video, I start by analyzing the yearly down to the daily charts, highlighting key trading zones, and discussing the confirmations we look for to optimize our swing entries.

If you like the breakdown, boost the idea and follow to receive more ideas.

Trade safely

Trader Leo

AUDUSD - Top-down Analysis ReviewThis is an AUDUSD top-down analysis using ICT concepts along with some of my own considerations. I demonstrate how I work my way down all the way from the 12-month timeframe to the daily timeframes. Everything is relevant, especially the bodies of the candles.

Read the chart this way and have insights you would otherwise never have.

- R2F

Why we don't trust this bounce on AUD/JPYMy short AUD/JPY bias sprang into action quicker than I expected two weeks ago. While support has since been found, it looks like it wants to retrace against that initial drop. Yet I have my eyes on the bigger (and more bearish) prize, and when comparing this cross to other yen pairs, I suspect another leg lower could be due when the current bounce fizzles out as anticipated.

MS

The RBA just made a small (but big) change to their statementThe RBA held rates at 4.35% as expected, but there were several changes to their December statement which warrant a closer look. I highlight the key differences to the November statement and provide my interpretation of what it means for the RBA's policy as we head into next year, then look at AUD/USD.

MS

This is why AUD/USD bears need to watch USD/CNHBets are back on for the RBA to cut, with markets having now fully priced in three 25bp cuts beginning in April. Weak GDP was the culprit, which leaves the Aussie susceptible to further weakness should incoming data continue to deteriorate. However, Aussie bears may also need to factor the yuan into the equation.

Risk could plunge in 2025 if AUD/JPY clues are correctAUD/JPY is a classic barometer of risk. So I find it quite interesting to see that price action clues on the monthly chart are not too dissimilar to what we saw ahead of the GFC high in 2007. And if AUD/JPY plunges, the chances are it means global markets will also be in turmoil.

MS.

Elections aside, AUD/USD still looks oversoldImplied volatility has spiked for FX majors ahead of the US election, and it really could go either way for AUD/USD depending on who wins the race to the Whitehouse. But how much downside is left for the Aussie when taking market positioning, China data and the latest RBA statement into account?

MS

Reading The Tape (ICT) Part 2 - 23th Sept 2024This is part 2 of a video, since TradingView does not allow recordings over an hour. Also the previous title had the date wrong, it is 23rd Sept, not 9th.

In this video I practice reading the tape using ICT Concepts, as well as offering general advice to those using his concepts or otherwise.

I hope that you find this video insightful. If you have any questions, leave a comment and I will be glad to answer.

- R2F

Reading The Tape (ICT) Part 1 - 9th Sept 2024In this video I practice reading the tape using ICT Concepts, as well as offering general advice to those using his concepts or otherwise.

I hope that you find this video insightful. If you have any questions, leave a comment and I will be glad to answer.

- R2F

How to track the US dollar's direction?A lowering of U.S. interest rates may be necessary, but the downside risk is a weaker USD. And a significantly weaker dollar may cause inflation to creep back up again.

Today, I will share a little hack on how to track and preempt the U.S. dollar’s direction.

To conclude:

Long-term - Down

Mid-term - Range to a breaking point

Currencies Futures and Options

Minimum fluctuation:

0.00005 per AUD increment = $5.00

0.00005 per CAD increment = $5.00

0.00005 CHF increment = $6.25

0.000050 per Euro increment = $6.25

0.0001 per GBP increments = $6.25

0.0000005 per JPY increment = $6.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

WEEKLY FOREX FORECAST July 29-AUG 2: OIL INDICES GOLD SILVERThis is Part 1 of the Weekly Forex Forecast JuLY 22 - 26th

In this video, we will cover:

S&P500 NASDAQ DOW GOLD SILVER US OIL

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

WEEKLY FOREX FORECAST July 22-26th: EUR GBP AUD NZD CAD CHFThis is Part 2 of the Weekly Forex Forecast for July 22-26th.

In this video, we will cover:

USD Index, EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCAD, USDCHF, USDJPY

... and BitCoin

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Trade Like A Sniper - Episode 52 - AUDUSD - (2nd July 2024)This video is part of a video series where I backtest a specific asset using the TradingView Replay function, and perform a top-down analysis using ICT's Concepts in order to frame ONE high-probability setup. I choose a random point of time to replay, and begin to work my way down the timeframes. Trading like a sniper is not about entries with no drawdown. It is about careful planning, discipline, and taking your shot at the right time in the best of conditions.

A couple of things to note:

- I cannot see news events.

- I cannot change timeframes without affecting my bias due to higher-timeframe candles revealing its entire range.

- I cannot go to a very low timeframe due to the limit in amount of replayed candlesticks

In this session I will be analyzing AUDUSD, starting from the 3-Month chart.

If you want to learn more, check out my profile.