Triple EMA + Volume/Price SignalsOverview

This script merges three exponential moving averages (EMA) with adaptive volume thresholds to identify high-confidence trends. Unlike basic volume indicators, it triggers signals only when volume exceeds both a user-defined absolute value (e.g., 500k) and a percentage increase (e.g., 5%) – reducing noise in volatile markets.

Key Features

Triple EMA System:

Short (9), Medium (21), and Long (50) EMAs for trend direction.

Bullish Signal: Short EMA > Medium EMA > Long EMA.

Bearish Signal: Short EMA < Medium EMA < Long EMA.

Dual-Threshold Volume Confirmation:

Absolute Volume: Highlight bars where volume exceeds X (e.g., 500,000).

Percentage Increase: Highlight bars where volume rises by Y% (e.g., 5%) vs. prior bar.

Users can enable/disable either threshold.

Customizable Alerts:

Trigger alerts only when both EMA alignment and volume conditions are met.

How It Works

Trend + Volume Synergy:

A bullish EMA crossover alone might be a false breakout. This script requires additional volume confirmation (e.g., 500k volume + 5% spike) to validate the move.

Flexibility: Adjust thresholds for different assets:

Stocks: Higher absolute volume (e.g., 1M shares).

Crypto: Smaller absolute volume but larger % spikes (e.g., 10%).

Usage Examples

Swing Trading:

Set EMA lengths to 20/50/200 and volume thresholds to 500k + 5% on daily charts.

Scalping:

Use 5/13/21 EMAs with 100k volume + 3% spikes on 5-minute charts.

Indicators and strategies

Grok Scalper M5

//@version=5

indicator("Grok Scalper M5", overlay=true, shorttitle="GROK-M5")

// === Inputs ===

// --- Geral ---

timeframe = input.timeframe("5", "Timeframe (ex.: 5 para M5)", group="Configurações Gerais")

side_threshold = input.float(0.3, "Lateral Threshold (%)", minval=0.1, maxval=1.0, step=0.1, group="Configurações Gerais", tooltip="Diferença mínima para definir tendência")

// --- Períodos ---

ema5_period = input.int(5, "EMA5 Period", minval=1, group="Períodos")

ema9_period = input.int(9, "EMA9 Period", minval=1, group="Períodos")

ema20_period = input.int(20, "EMA20 Period", minval=1, group="Períodos")

ema41_period = input.int(41, "EMA41 Period", minval=1, group="Períodos")

ema8_period = input.int(8, "EMA8 Period (Sinal)", minval=1, group="Períodos")

sma50_period = input.int(50, "SMA50 Period", minval=1, group="Períodos")

sma100_period = input.int(100, "SMA100 Period", minval=1, group="Períodos")

ma200_period = input.int(200, "MA200 Period", minval=1, group="Períodos")

hilo_period = input.int(13, "HiLo Period", minval=1, group="Períodos")

rsi_period = input.int(5, "RSI Period", minval=1, group="Períodos")

candle_up = input.color(color.green, "Candle Up", group="Cores")

candle_down = input.color(color.red, "Candle Down", group="Cores")

candle_side = input.color(color.blue, "Candle Side", group="Cores")

ma_up = input.color(color.green, "Médias Up", group="Cores")

ma_down = input.color(color.red, "Médias Down", group="Cores")

ma_side = input.color(color.yellow, "Médias Side", group="Cores")

rsi_buy = input.int(40, "RSI Buy Level", minval=0, maxval=100, group="Filtros")

rsi_sell = input.int(60, "RSI Sell Level", minval=0, maxval=100, group="Filtros")

vol_mult = input.float(1.5, "Volume Multiplier", minval=1.0, step=0.1, group="Filtros", tooltip="Volume mínimo para validar sinal")

/

ema5 = ta.ema(close, ema5_period)

ema9 = ta.ema(close, ema9_period)

ema20 = ta.ema(close, ema20_period)

ema41 = ta.ema(close, ema41_period)

ema8 = ta.ema(close, ema8_period)

sma50 = ta.sma(close, sma50_period)

sma100 = ta.sma(close, sma100_period)

ma200 = ta.sma(close, ma200_period)

// HiLo

hilo = ta.sma((high + low) / 2, hilo_period)

// RSI

rsi = ta.rsi(close, rsi_period)

rsiBuyCond = rsi > rsi_buy and rsi > rsi

rsiSellCond = rsi < rsi_sell and rsi < rsi

// Volume

volMA = ta.sma(volume, 10)

volCond = volume >= volMA * vol_mult

// Tendência

diff = math.abs((ema5 - ema20) / close) * 100

isUp = ema5 > ema20 and close > hilo and diff > side_threshold

isDown = ema5 < ema20 and close < hilo and diff > side_threshold

isSide = not isUp and not isDown

// Coloração

maColor = isUp ? ma_up : isDown ? ma_down : ma_side

plot(ema5, color=maColor, title="EMA5", linewidth=1)

plot(ema9, color=maColor, title="EMA9", linewidth=1)

plot(ema20, color=maColor, title="EMA20", linewidth=1)

plot(ema41, color=maColor, title="EMA41", linewidth=1)

plot(ema8, color=maColor, title="EMA8", linewidth=1)

plot(sma50, color=maColor, title="SMA50", linewidth=1)

plot(sma100, color=maColor, title="SMA100", linewidth=1)

plot(ma200, color=maColor, title="MA200", linewidth=2)

plot(hilo, color=color.purple, title="HiLo", linewidth=1)

ShivShakti V1.0Buy Sell Signal Trend following indicator

This indicator is combination of Supertrend,RSI,EMA 20 and ADX with custom logic based on price action

Daily Separator with Daythis indicator about vertical lines at weekly days. Add at chart a 2 part of this indicator - Weekdays Labels to have all advantages this indicator

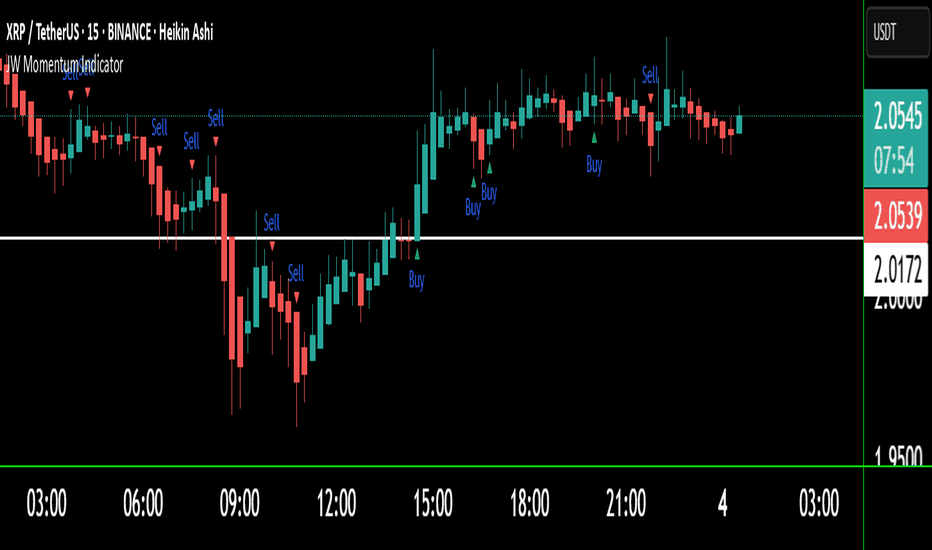

JW Momentum IndicatorJW Momentum Indicator

This indicator provides clear and actionable buy/sell signals based on a combination of volume-enhanced momentum, divergence detection, and volatility adjustment. It's designed to identify potential trend reversals and momentum shifts with a focus on high-probability setups.

Key Features:

Volume-Enhanced Momentum: The indicator calculates a custom oscillator that combines momentum with volume, giving more weight to momentum when volume is significant. This helps to identify strong momentum moves.

Divergence Detection: It detects bullish and bearish divergences using pivot highs and lows, highlighting potential trend reversals.

Volatility-Adjusted Signals: The indicator adjusts signal sensitivity based on the Average True Range (ATR), making it more reliable in varying market conditions.

Clear Visuals: Buy and sell signals are clearly indicated with up and down triangles, while divergences are highlighted with distinct labels.

How to Use:

Buy Signals: Look for green up triangles or bullish divergence labels.

Sell Signals: Look for red down triangles or bearish divergence labels.

Oscillator and Thresholds: Use the plotted oscillator and thresholds to confirm signal strength.

Parameters:

Momentum Period: Adjusts the length of the momentum calculation.

Volume Average Period: Adjusts the length of the volume average calculation.

Volatility Period: Adjusts the length of the ATR calculation.

Volatility Multiplier: Adjusts the sensitivity of the volatility-adjusted signals.

Disclaimer:

This indicator is for informational purposes only and should not be considered financial advice. Always conduct 1 thorough research and use appropriate risk management techniques when trading.

H1 Candle Reference + n Pips TargetThis indicator uses the H1 candle at a specified time (default 8:00) to set daily reference levels. It captures the high and low of the 8:00 H1 candle and displays them as blue horizontal lines across all timeframes for the rest of the day. Additionally, it plots two red target lines, set a fixed number of ticks above and below these reference levels.

Trama gradientsshows the gradients of 3 Luxalgo 'TRAMA' lines (length of 20,50 and 200) (trend regularity adaptive moving average), and displays the distance between price, and this value of the 200 TRAMA

GQT GPT - Volume-based Support & Resistance Zones V2搞钱兔,搞钱是为了更好的生活。

Title: GQT GPT - Volume-based Support & Resistance Zones V2

Overview:

This strategy is implemented in PineScript v5 and is designed to identify key support and resistance zones based on volume-driven fractal analysis on a 1-hour timeframe. It computes fractal high points (for resistance) and fractal low points (for support) using volume moving averages and specific price action criteria. These zones are visually represented on the chart with customizable lines and zone fills.

Trading Logic:

• Entry: The strategy initiates a long position when the price crosses into the support zone (i.e., when the price drops into a predetermined support area).

• Exit: The long position is closed when the price enters the resistance zone (i.e., when the price rises into a predetermined resistance area).

• Time Frame: Trading signals are generated solely from the 1-hour chart. The strategy is only active within a specified start and end date.

• Note: Only long trades are executed; short selling is not part of the strategy.

Visualization and Parameters:

• Support/Resistance Zones: The zones are drawn based on calculated fractal values, with options to extend the lines to the right for easier tracking.

• Customization: Users can configure the appearance, such as line style (solid, dotted, dashed), line width, colors, and label positions.

• Volume Filtering: A volume moving average threshold is used to confirm the fractal signals, enhancing the reliability of the support and resistance levels.

• Alerts: The strategy includes alert conditions for when the price enters the support or resistance zones, allowing for timely notifications.

⸻

搞钱兔,搞钱是为了更好的生活。

标题: GQT GPT - 基于成交量的支撑与阻力区间 V2

概述:

本策略使用 PineScript v5 实现,旨在基于成交量驱动的分形分析,在1小时级别的图表上识别关键支撑与阻力区间。策略通过成交量移动平均线和特定的价格行为标准计算分形高点(阻力)和分形低点(支撑),并以自定义的线条和区间填充形式直观地显示在图表上。

交易逻辑:

• 进场条件: 当价格进入支撑区间(即价格跌入预设支撑区域)时,策略在没有持仓的情况下发出做多信号。

• 离场条件: 当价格进入阻力区间(即价格上升至预设阻力区域)时,持有多头头寸则会被平仓。

• 时间范围: 策略的信号仅基于1小时级别的图表,并且仅在指定的开始日期与结束日期之间生效。

• 备注: 本策略仅执行多头交易,不进行空头操作。

可视化与参数设置:

• 支撑/阻力区间: 根据计算得出的分形值绘制支撑与阻力线,可选择将线条延伸至右侧,便于后续观察。

• 自定义选项: 用户可以调整线条样式(实线、点线、虚线)、线宽、颜色及标签位置,以满足个性化需求。

• 成交量过滤: 策略使用成交量移动平均阈值来确认分形信号,提高支撑和阻力区间的有效性。

• 警报功能: 当价格进入支撑或阻力区间时,策略会触发警报条件,方便用户及时关注市场变化。

⸻

Fibonacci Trend TradingRules:

1. Trading Bias

Bullish

Price > EMA 200 = Bullish

Price < EMA 200 = Bearish

2. Trade signal

- Fibonacci retracement @ 50% - 61.8% for LONG

- Fibonacci retracement @61.8% - 78.6% for SHORT

- Look for engulfing candle before entering

3. TP, recent high

4. Trail Stop EMA 10 crossover or session end.

5. Trading session London and NY

Heikin Ashi Buy/Sell with Custom TimeframeSimple indicator that can catch trend,it helps to catch trends,prevent noise and uses heikin ashi calculation

XTE+ Optimized Trend Tracker📊 XTE+ Optimized Trend Tracker (OTT)

XTE+ OTT is a powerful, trend-following indicator designed for traders who value clarity, precision, and advanced analytics. It offers not only accurate entry and exit signals but also visual zones, historical signal analysis, and real-time trend monitoring.

🧠 How It Works

XTE+ OTT is based on an improved version of the Optimized Trend Tracker. It utilizes multiple customizable moving average types (VAR, EMA, SMA, WMA, and more) combined with volatility filtering (ATR logic) to generate cleaner, more reliable trend-following signals.

✅ Features

Trend Direction Detection with automatic switch logic

Buy/Sell Signal Icons with distinct large markers

Entry/Exit Zones drawn visually on chart

Custom Take-Profit / Stop-Loss settings for Buy and Sell signals

Statistical Panel showing:

Current Trend (Up/Down)

Number of total signals

Number of winning trades

Win percentage

Configurable Display Options:

Show/hide signals

Show/hide trend zones

Show/hide OTT and MA lines

Supports multiple MA types including EMA, SMA, VAR, ZLEMA, TSF and more

Non-repainting logic — signals are confirmed at bar close

⚙️ Inputs and Customization

OTT Period & Sensitivity (%)

MA Type Selection (VAR, EMA, etc.)

Entry Zone Visualization On/Off

Trend Panel Display On/Off

TP/SL % per direction (Buy/Sell separately)

Option to disable MA or OTT line display

📈 Visuals

Signal icons: BUY (Green Up Label), SELL (Red Down Label)

Entry zones: circles near breakout levels

Trendlines change color dynamically (green for uptrend, red for downtrend)

Trend Panel is pinned in the top-right corner for quick reference

💡 Usage Tips

Best used on higher timeframes (15min, 1H, 4H+) for more meaningful trend signals

Combine with volume/volatility indicators or support/resistance zones for enhanced decision making

Use TP/SL logic to track signal success over time and optimize strategies

📌 Disclaimer

This script is for educational and informational purposes only. It is not financial advice. Always test and validate your strategy before applying it in live markets.

Custom VWAPThe Custom VWAP indicator provides traders with a streamlined approach to tracking Volume Weighted Average Price (VWAP) across multiple timeframes. Unlike standard VWAP indicators that limit users to a single timeframe, this tool allows multiple VWAPs to be enabled simultaneously, including Session, Weekly, Monthly, Yearly, and an RTH (Regular Trading Hours) VWAP.

Features:

Multi-Timeframe Support: Enable or disable individual VWAPs without adding multiple indicators.

RTH VWAP Option: Includes a dedicated RTH VWAP, which is not available in the standard TradingView VWAP tool.

Customizable Labels & Styling: Adjust colors, line widths, and label placements to match your charting preferences, keeping the chart organized.

Horizontal VWAP Lines: Optional horizontal lines provide clear price level visualization.

Automatic Reset: VWAPs update at the start of each session, week, month, or year, ensuring accurate calculations without manual adjustments.

This indicator is useful for traders who rely on VWAP levels for decision-making while keeping their charts clean and efficient.

Turnover in CroreA simple indicator for turnover in crores.

You can set a threshold volume of your choice, and the indicator will display volumes below this threshold in red and volumes above it in green.

Smart Dynamic Levels [ATR-Based]Smart Dynamic Levels

Automated Support & Resistance Levels Based on Market Volatility

Overview:

This advanced indicator automatically plots dynamic support and resistance levels based on the Average True Range (ATR), creating meaningful price zones that adapt to changing market conditions. Unlike static round-number levels, these volatility-adjusted zones provide more relevant technical reference points.

Key Features:

Volatility-Responsive: Levels automatically adjust based on the asset's ATR

Smart Visualization:

Color gradient shows strength of each level (darker = stronger)

Bullish (green) levels below price, bearish (red) levels above

Customizable Settings:

Adjust ATR length (14-period default)

Modify level sensitivity with ATR multiplier (1.5x default)

Choose number of levels to display (5 above/below default)

Toggle labels and line extensions

How It Works:

Calculates the asset's true volatility using ATR

Rounds to significant price intervals based on current volatility

Plots equidistant levels above and below current price

Colors levels based on their position relative to price

Automatically updates as market conditions change

Recommended Use:

Day Trading: Identify intraday support/resistance zones

Swing Trading: Spot potential reversal areas

Breakout Trading: Watch for moves beyond key levels

Works on all markets: Stocks, Forex, Crypto, Futures

Settings Guide:

ATR Length: Higher values for smoother levels (14-20)

Multiplier: Increase for wider levels (1.5-3x)

Levels Count: More levels for higher timeframes (3-10)

Pro Tips:

Combine with trend analysis - levels are more significant when aligned with trend

Watch for price reactions at these levels for confirmation

Use wider levels (higher multiplier) for volatile assets

Impulse Candle IdentifierWhat It Does

• Marks bullish impulse candles with a green triangle.

• Marks bearish impulse candles with a red triangle.

• Optionally highlights the impulse candles in the background.

Customize It

• Increase body_multiplier to only catch the most aggressive candles.

• Adjust volume_multiplier if your market has low or high volume fluctuations.

Проторговка с прямоугольниками и уведомлениямиThe script detects consolidation zones. It works simply.

It takes n bars of history (15 by default) – this is the period used to search for levels. You may need to adjust this depending on the coin, but 15 usually works well.

"Total volume threshold for consolidation" – this is set to a high default value. You should adjust it based on the asset you're analyzing.

"Consolidation accumulation color" – the color used when volume is dropping.

"High volatility color" – the color used when volume is approaching the "Total volume threshold for consolidation."

How the indicator works:

The indicator draws a box covering the last 15 candles. It monitors whether the box is compressing – meaning the support and resistance levels are getting closer (even by a small amount). It remembers this moment.

Second condition: the total volume must be below the specified threshold.

If both conditions are met, an alert is triggered, which you can subscribe to.

How to use it:

If the indicator catches your attention, observe which direction the price is being squeezed. Squeezing means both green and red candles are forming near the support/resistance level.

If the squeeze aligns with your formation or setup, you can consider entering a position. Stop-loss can be set just below the nearest low.

Trendlines

This indicator doesn’t detect trendline breakouts, but it still fires alerts based on compression logic, which can also work for flags. You’ll want to watch for price being pressed against trendline levels.

Canadian Elections & PM TimelineThis script displays major Canadian federal election years along with the names and party affiliations of elected Prime Ministers, directly on your price chart. It provides a quick visual reference for key political events that may have had market impact, helping traders correlate price movements with changes in leadership.

Nifty 0.4% Options Strategy [15min]How This Works:

Entries:

CALL when Nifty moves +0.4% from previous close

PUT when Nifty moves -0.4% from previous close

Exits:

Automatically closes all positions after specified bars (default: 4 bars = 1 hour)

Visuals:

Gray line: Previous day's close

Green circles: +0.4% threshold

Red circles: -0.4% threshold

Combined + Reversal By DemirkanThis indicator is a comprehensive tool designed to identify potential trend reversals, trend direction, and entry/exit points by combining multiple technical analysis instruments. It includes the following components:

Two Reversal Lines (Based on Donchian Channel): Two lines with different periods indicate potential support/resistance levels and trend changes.

Hull Moving Average (HMA): A smoother, less lagging moving average helps determine trend direction and short-term momentum.

Fibonacci Level: A dynamic Fibonacci retracement level, calculated based on the highest high and lowest low over a specific period, serves as a potential support or area of interest.

Signal Generation: Produces Buy/Sell signals based on the crossovers and conditions of these components.

Visual Aids: Enhances interpretation by coloring the area between lines, coloring candlesticks, and adding labels.

Detailed Component Description:

Input Parameters (Settings):

Reversal Line 1 Length (Default: 100): The period (number of bars) used to calculate the first reversal line. Longer periods capture slower, more significant trends.

Reversal Line 2 Length (Default: 33): The period used to calculate the second reversal line. Shorter periods react to faster, shorter-term changes.

HMA Length (Default: 100): The period for calculating the Hull Moving Average.

Source (Default: close): The price source used for all calculations (close, open, high, low, etc.).

Reversal Line Bar Offset (Default: 3): Determines how many bars forward the Reversal Lines are shifted on the chart. This can make signals appear slightly earlier (or later, depending on the strategy). 0 means no shift.

Fibonacci Level (Default: 0.382): Specifies the Fibonacci retracement level (between 0.0 and 1.0). Common levels like 0.382, 0.5, 0.618 can be used.

Lookback Period (Default: 20): The period (number of bars) over which to look back for the highest high and lowest low to calculate the Fibonacci level.

Price Margin (Default: 0.005): Tolerance (as a percentage) determining how close the price needs to be to the Fibonacci level to be considered "at the level". E.g., 0.005 = 0.5%. If the price is within 0.5% of the calculated Fibonacci level, the condition is met.

Calculations:

donchian(len) Function: Calculates the average (math.avg) of the highest high (ta.highest) and lowest low (ta.lowest) over a specific period (len). This is effectively the midline of a classic Donchian Channel and is used here as the "Reversal Line".

Reversal Lines (conversionLine1, conversionLine2): Calculated using the donchian function based on the user-defined conversionPeriods1 and conversionPeriods2 lengths.

Hull Moving Average (hullMA): Calculated using the hma function. This function uniquely combines Weighted Moving Averages (WMA) to achieve less lag.

Fibonacci Level Calculation (fibLevel1, isAtFibLevel): Finds the highest high and lowest low within the lookbackPeriod, calculates the range (priceRange). fibLevel1 is determined by subtracting priceRange * fibLevel from the highest high (representing a retracement level). isAtFibLevel checks if the current closing price is within the priceMargin tolerance of the calculated fibLevel1.

Visual Elements (Plots/Drawing):

plot(conversionLine1 , ...): Plots the first reversal line in blue, shifted forward by barOffset.

plot(conversionLine2 , ...): Plots the second reversal line in black, shifted forward by barOffset.

plot(hullMA, ...): Plots the Hull Moving Average in orange.

plot(fibLevel1, ...): Plots the calculated Fibonacci level as a light blue, dashed line.

fill(...): Fills the area between the two (shifted) reversal lines. The area is colored blue if conversionLine1 > conversionLine2 (often interpreted as bullish) and red otherwise (bearish). The color transparency is set to 90 (almost opaque).

label.*: Adds labels at trend change points. A "Buy" label appears when the area turns blue (Line 1 crosses above Line 2), and a "Sell" label appears when it turns red (Line 1 crosses below Line 2). Labels appear once when the trend starts and are updated/deleted when the trend changes.

plotshape(...): Plots shapes (arrows/labels) on the chart when specific conditions are met:

Reversal Crossover Signals: A green up arrow (shape.labelup) appears when conversionLine2 crosses above conversionLine1 (Buy Signal - buySignal). A red down arrow (shape.labeldown) appears when conversionLine1 crosses below conversionLine2 (Sell Signal - sellSignal).

Hull MA Signals: A green up arrow (hullBuySignal) appears when the price closes above the HMA after being below it. A red down arrow (hullSellSignal) appears when the price closes below the HMA after being above it.

Fibonacci Buy Signal: A purple up arrow (fibBuySignal) appears when both the price is near the calculated Fibonacci level (isAtFibLevel) and a Hull MA Buy signal (hullBuySignal) occurs simultaneously. This signifies a "confluence" signal.

barcolor(...): Changes the color of the candlesticks. Bars turn blue on a Hull MA Buy signal (hullBuySignal) and red on a Hull MA Sell signal (hullSellSignal). Otherwise, the bar color remains the default chart color.

How to Use / Interpret:

Trend Direction:

Observe the color of the filled area between the reversal lines (Blue = Uptrend, Red = Downtrend).

Note whether the price is above or below the Hull MA.

Consider the slope of the Hull MA (upward or downward).

Entry/Exit Signals:

Aggressive: Use the crossovers of the reversal lines (buySignal, sellSignal). Green arrow suggests buy, red arrow suggests sell.

Trend Following: Use the HMA crossovers (hullBuySignal, hullSellSignal). Green arrow suggests buy, red arrow suggests sell. The bar colors also confirm these signals visually.

Confirmed Buy: Look for the Fibonacci Buy Signal (Purple arrow). When the price reaches a potential support level (Fibonacci) and simultaneously gets an HMA Buy signal, it can be considered a stronger buy indication.

Support/Resistance:

The reversal lines themselves can act as dynamic support/resistance levels.

The plotted Fibonacci level (fibLevel1) can be monitored as a potential retracement and support zone.

Strategy:

Confluence (multiple signals aligning) can increase confidence. For example, a buySignal or hullBuySignal occurring while the HMA is pointing up and the fill area is blue might be considered stronger.

Adjust the barOffset parameter to fine-tune the timing of the visual signals according to your trading style.

Use the Fibonacci Buy signal to potentially find entry points after pullbacks in an uptrend or near potential bottoms after a decline.

Important Notes:

No single indicator provides 100% accurate signals. It's crucial to use this indicator in conjunction with other analysis methods (price action, chart patterns, volume, etc.) and sound risk management strategies.

The indicator's performance might vary in different market conditions (trending, sideways) and across different timeframes. Backtesting before live trading is recommended.

The barOffset value shifts the plotting of the lines forward visually but does not change the time at which the underlying calculation occurs (it's still based on the data up to the current closing bar).

15-Min Breakout Strategy✅ Marks the highest high & lowest low from the 2nd and 3rd 15-minute candles

✅ Plots horizontal lines from the 3rd candle onwards (not extending forever)

✅ Detects when the next candle (4th or beyond) crosses these levels

✅ Plots a Green "Buy Signal" if price breaks the highest high

✅ Plots a Red "Sell Signal" if price breaks the lowest low

VIDYA Auto-Trading(Reversal Logic)Overview

This script is a dynamic trend-following strategy based on the Variable Index Dynamic Average (VIDYA). It adapts in real time to market volatility, aiming to enhance entry precision and optimize risk management.

⚠️ This strategy is intended for educational and research purposes. Past performance does not guarantee future results. All results are based on historical simulations using fixed parameters.

Strategy Objectives

The objective of this strategy is to respond swiftly to sudden price movements and trend reversals, providing consistent and reliable trade signals under historical testing conditions. It is designed to be intuitive and efficient for traders of all levels.

Key Features

Momentum Sensitivity via VIDYA: Reacts quickly to momentum shifts, allowing for accurate trend-following entries.

Volatility-Based ATR Bands: Automatically adjusts stop levels and entry conditions based on current market volatility.

Intuitive Trend Visualization: Uptrends are marked with green zones, and downtrends with red zones, giving traders clear visual guidance.

Trading Rules

Long Entry: Triggered when price crosses above the upper band. Any existing short position is closed.

Short Entry: Triggered when price crosses below the lower band. Any existing long position is closed.

Exit Conditions: Positions are reversed based on signal changes, using a position reversal strategy.

Risk Management Parameters

Market: ETHUSD(5M)

Account Size: $3,000 (reasonable approximation for individual traders)

Commission: 0.02%

Slippage: 2 pip

Risk per Trade: 5% of account equity (adjusted to comply with TradingView guidelines for realistic risk levels)

Number of Trades: 251 (based on backtest over the selected dataset)

⚠️ The risk per trade and other values can be customized. Users are encouraged to adapt these to their individual needs and broker conditions.

Trading Parameters & Considerations

VIDYA Length: 10

VIDYA Momentum: 20

Distance factor for upper/lower bands: 2

Source: close

Visual Support

Trend zones, entry points, and directional shifts are clearly plotted on the chart. These visual cues enhance the analytical experience and support faster decision-making.

Visual elements are designed to improve interpretability and are not intended as financial advice or trade signals.

Strategy Improvements & Uniqueness

Inspired by the public work of BigBeluga, this script evolves the original concept with meaningful enhancements. By combining VIDYA and ATR bands, it offers greater adaptability and practical value compared to conventional trend-following strategies.

This adaptation is original work and not a direct copy. Improvements are designed to enhance usability, risk control, and market responsiveness.

Summary

This strategy offers a responsive and adaptive approach to trend trading, built on momentum detection and volatility-adjusted risk management. It balances clarity, precision, and practicality—making it a powerful tool for traders seeking reliable trend signals.

⚠️ All results are based on historical data and are subject to change under different market conditions. This script does not guarantee profit and should be used with caution and proper risk management.

Ehlers Reverse EMAOverview

The Ehlers Reverse EMA is an advanced momentum indicator designed by John Ehlers and implemented here with additional features for improved trading decision-making. This indicator helps identify trend direction, potential reversals, and generates precise buy/sell signals based on multiple confirmation methods.

What Makes It Unique

Unlike conventional EMAs, the Ehlers Reverse EMA uses a sophisticated reverse-engineering approach to provide smoother, more responsive signals with reduced lag. The indicator combines a proprietary EMA calculation with optional moving average confirmation to filter out market noise and highlight meaningful price movements.

Features

Dynamic Color Coding: Green when momentum is positive, red when negative

Moving Average Overlay: Optional MA with selectable types (SMA, EMA, WMA, VWMA)

Multiple Signal Generation Methods:

Zero-Line Crossovers: Signals when momentum shifts from positive to negative or vice versa

MA Crossovers: Signals when the Ehlers EMA crosses its own moving average

Combined Confirmation: Requires both zero-line and MA crossovers for highest probability signals

On-Chart Signal Visualization: Clear buy/sell arrows directly on the price chart

Customizable Parameters: Adjust alpha value, MA type, and signal generation to suit your trading style

How To Use

Add the main "Ehlers Reverse EMA" indicator to your chart

Add the companion "EREMA Signals" indicator to display buy/sell signals on the price chart

Ensure both indicators have matching settings for consistency

Signal Interpretation

Buy Signals (Green Triangles): Appear below price bars when conditions are met

Sell Signals (Red Triangles): Appear above price bars when conditions are met

Recommended Timeframes

Works well on all timeframes from 5-minute to daily charts. For swing trading, 4H or daily timeframes often provide the most reliable signals.

Strategy Applications

Trend Following: Use zero-line crossovers to enter with the trend

Momentum Trading: Use MA crossovers for entry and exit points

Confirmation Tool: Combine with price action or other indicators for higher-probability trades

Divergence Analysis: Compare indicator movement with price action to spot potential reversals

Parameter Settings

Alpha (Default: 0.1): Lower values create smoother lines but more lag; higher values increase responsiveness but may increase false signals

MA Length (Default: 14): Adjust based on your trading timeframe and style

This versatile indicator helps identify high-probability trading opportunities while filtering out market noise, making it valuable for both novice and experienced traders alike.

Weekday Labels with Infinite Vertical LinesThis indicator is 2 part of "Daily Separator with Day". Add this indicator for open all adventage this 2 indicator