Divergence Since 2020 - What Happens When Bonds Continue?When Stocks & Bond Move Opposite Direction what does it mean?

We have observed a divergence between the stock and bond markets since 2020. While U.S. Treasury bonds entered a bear zone, the stock markets continued their upward climb. What are the implications of this decoupling?

Will the stock market resume its uptrend and hit new highs? Or is this merely a retracement before further downward pressure?

A healthy, three-way interdependent relationship occurs when the economy, bonds, and stocks move in the same direction. When investors have confidence in the U.S. economy, they tend to invest in long-term bonds, which it usually will benefits the stock market.

This alignment was evident between 2000 and 2020, during which bonds and stocks moved largely in tandem.

However, from 2020 onward, bonds began declining—signaling a loss of investor confidence in the economy. Technically, this should exert downward pressure on stocks as well.

Yet, we are witnessing a divergence: Where U.S. Treasury bonds have fallen while stocks have continued to rise.

When such a divergence surfaces, it signals the need for caution in our approach in the stock markets.

What could be the other reasons why US T-bond has peaked in 2020 and depreciated by 44% since then?

Micro E-mini Nasdaq Futures and Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

ZB1! trade ideas

ZB1! - Low Hanging Fruits Pays The Bills!Please refer to US10Y Yields if you want a detailed, 360 analysis of the bond and yields market as I cover the reasons why price action has been soo tricky recently and what to expect going forward.

Low hanging fruits if important right now and studying the daily timeframe throughout next week will give me the indication whether 116.18 will be a good price for the bonds to reverse from or a springboard for higher prices

Areas of interest long & short in the 30Y TreasuryOverall I feel yields will be rising rather than falling, I am not concerned of what the catalyst might be to cause this but simply following the price action particularly on the 10YR Yield. So that being said I am bearish the 30YR treasury. However, if price retraces down to the lower zone drawn (113) we could see a nice rally up to the higher/larger zone drawn.

At the higher zone (117-118) I would make sense that this un-tested area where the supply exceeded the demand would likely hold and we would see a nice short play out. The target(s) on the short side will be updated once price action has come to fruition as price moves into these zones but a move down to at least the April lows of 106 isn't hard to imagine.

US Bond Slide Began in 2020 — Not Tariff-Driven. Why?The downward pressure did not start with the Liberation Day tariffs on 2nd April.

Based on the 30-year long-term bond price chart, the market peaked in 2020, then broke below a major support line—established since the 1980s—in 2022.

Since that break, US bonds have been on a downward trajectory.

So, what happened in 2020 and 2022 that set the bond market on shaky ground?

In 2020, the massive Covid QE signaled a tipping point in the debt issue that had been discussed for decades. By June 2022, inflation reached 9%, the highest in four decades. Investors grew concerned about the US's dependence on debt as the bond bubble appeared to burst.

Why is the recent tariff shock just a continuation of developments that began back then?

And where are bond prices heading next?

This goes beyond investors offloading its US Treasury holdings after 2nd April.

U.S. Treasury Futures & Options

Ticker: ZB

Minimum fluctuation:

1/32 of one point (0.03125) = $31.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

Trading the Micro: cmegroup.com/markets/microsuite.html

Why Is the T Bond Heading Down?The downward pressure did not start with the Liberation Day tariffs on 2nd April.

Based on the 30-year long-term bond price chart, the market peaked in 2020, then broke below a major support line—established since the 1980s—in 2022.

Since that break, US bonds have been on a downward trajectory.

So, what happened in 2020 and 2022 that set the bond market on shaky ground?

Why is the recent tariff shock just a continuation of developments that began back then?

And where are bond prices heading next?

This goes beyond investors offloading its US Treasury holdings after 2nd April.

U.S. Treasury Futures & Options

Ticker: ZB

Minimum fluctuation:

1/32 of one point (0.03125) = $31.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

ZB1! - Donald Trump Took A Huge Dump In The Bonds MarketIt was only two weeks ago when market participants were cheering on the bond market for it to rally higher.... until al hell broke loose!

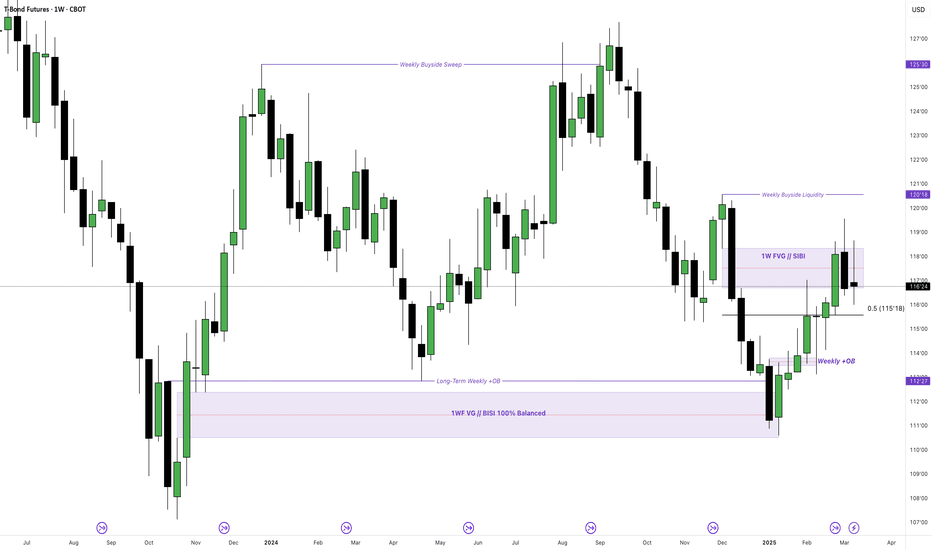

120.18 was the initial draw on liquidity before the bond market capitulated into October 2023 BISI.

What's net on the horizon?

FERRIS BULLERS DAY OFF - READ DESCRIPTIONWho knows... just posting this to watch.

"In 1930 the republican controlled house of representatives in and effort to alleviate the effects of....

anyone, anyone??

GREAT DEPRESSION....

Passed the....

anyone, anyone??

tariff bill - the Halwey-Smoot Tariff act which

Anyone??

Raised or Lowered? RAISED

Raised tariffs in an effort to collect more revenue for the federal government.

Did it Work?

Anyone, Anyone know the effects?

IT did not work and the United States Sank deeper into the great depression!

-FERRIS BULLERS DAY OFF

Bond Yields Ripping, Will Wall Street Take Notice?Rising yields can usually be associated with a period of risk on. But seeing the 30-year treasury yield rise over 20bp in Asia while Wall Street futures cling on to their cycle lows is anything but usual. In fact, it's a bad omen of things to come.

Matt Simpson, Market Analyst at City Index and Forex.com

ZB1! - Will Donald Trump Pump The Bond Market? On Wednesday, Trump mentioned the need to lower interest rates as the tariffs will have major effects with the rates being where they are at now.

In the last, whenever yields rise, bonds will fall and we have been seeing this from the beginning of September 2024, with minor signs of retracement (factoring Jan 2025 bull run)

Overall, when you look at price action over the past few weeks, it seems as though the bull run has slowed down and there could be a chance for bonds to drop to 116 going into next week.

ZB1! 18/03/25Here we go. Longs on Treasury bonds. Weekly BISI with H4 SMT and displacement. Targeting previous weeks high for this week. FOMC on Wednesday:

- If the Fed signals rate cuts are coming soon (Dovish tone) → Bullish for Bonds

Yields may drop as investors price in lower future rates.

Bond prices rise, benefiting Treasuries and fixed-income investments.

- If the Fed remains cautious and pushes cuts further out (Hawkish tone) → Bearish for Bonds

Yields could stay elevated or even rise if the Fed signals rates will stay high longer.

Bond prices fall, as higher-for-longer rates make existing bonds less attractive.

I'm believing a dovish tone for this FOMC with rates being held. If rates are not held expect a massive shock. Powell's economic projections will also provide key information on their stance.

ZB1! -MASSIVE Week Ahead With Interest Rates There is a strong correlation between bonds and yields and so far, the trajectory of price action for bonds has been in my favour, trailing higher and higher into the weekly premium SIBI.

115.18 is the equilibrium of the most immediate swing high to swing low and I am expecting a draw into this area.

116 is a low hanging, first target for next week that I am aiming for and would like to see how Sundays opening reacts (if that’s the case) with 116.

ZB1! - Perfection With SIBI RejectionThis weeks delivery has efficiently delivered into a PD array mentioned previous weeks back.

Although bullish, the goal was not to predict the weeks close, just anticipate the draw on liquidity.

Aiming for low hanging fruits, I am looking at the 115.18 weekly EQ as a possible draw going into next week.

$BONDS MMSMWhen analyzing the bonds, we identified an SMT between them at a PDA located in the monthly premium region, further reinforcing the possibility of a DXY rally and a drop in EURUSD, along with bond depreciation. However, to validate this scenario, we still need confirmations on the daily chart to ensure that the bias remains aligned with the market structure.

ZB1! - End of February Analysis- Monthly bullish order block has held up well, supporting the bullish narrative of price drawing up to 120.00

- Monthly candle closed convincingly above the 3 month rejection block @ 117.08.

- Monthly volume imbalance rests a little higher than where the monthly buyside liquidity pool is @ 120.25 – 121.23. Buyside rests @ 120.18 and this is the draw that I am looking forward to going into this months price action

- October 2024’s monthly candle prints a SIBI and this is also a area to study. Many confluences in this area making it high probability for a bullish draw. Bullish delivery with bonds mean bearish delivery for US10Y.

- Successful projection of February's draw on liquidity

ZB1! - Immaculate Draw on Buystops! What’s Next?This weeks breakdown covers the similarities bonds and yields have and as mentioned in my most recent analysis with Yields, I was loooking for a draw down to discounted prices.

With that bias in mind, Bonds would be more likely to trade higher as they both highly correlated.

ZB1! - Immaculate Draw on Buystops! What’s Next?This weeks breakdown covers the similarities bonds and yields have and as mentioned in my most recent analysis with Yields, I was loooking for a draw down to discounted prices.

With that bias in mind, Bonds would be more likely to trade higher as they both highly correlated.