Next report date

≈

August 8

Report period

Q1 2025

EPS estimate

0.96 INR

Revenue estimate

6.26 B INR

2.25 INR

726.87 M INR

20.67 B INR

117.93 M

About HONASA CONSUMER LTD

Sector

Industry

CEO

Varun Alagh

Website

Headquarters

Gurugram

Founded

2016

ISIN

INE0J5401028

FIGI

BBG01JXCMJK6

Honasa Consumer Pvt Ltd. manufactures and sells baby care products. It engages in the business of trading beauty and personal care products and related services with products across baby care, skin care, hair and other personal care categories. Its brands include Mamaearth, The Derma Co., Aqualogica, Ayuga, BBlunt, Dr. Sheth's, BBlunt Salons and Momspresso. The company was founded by Varun Alagh and Ghazal Alagh on September 16, 2016, and is headquartered in Gurugram, India.

−8%

−4%

0%

4%

8%

Q4 '23

Q1 '24

Q2 '24

Q3 '24

Q4 '24

−2.00 B

0.00

2.00 B

4.00 B

6.00 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

1.50 B

3.00 B

4.50 B

6.00 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

1.50 B

3.00 B

4.50 B

6.00 B

Q4 '23

Q1 '24

Q2 '24

Q3 '24

Q4 '24

0.00

1.30 B

2.60 B

3.90 B

5.20 B

Debt

Free cash flow

Cash & equivalents

No news here

Looks like there's nothing to report right now

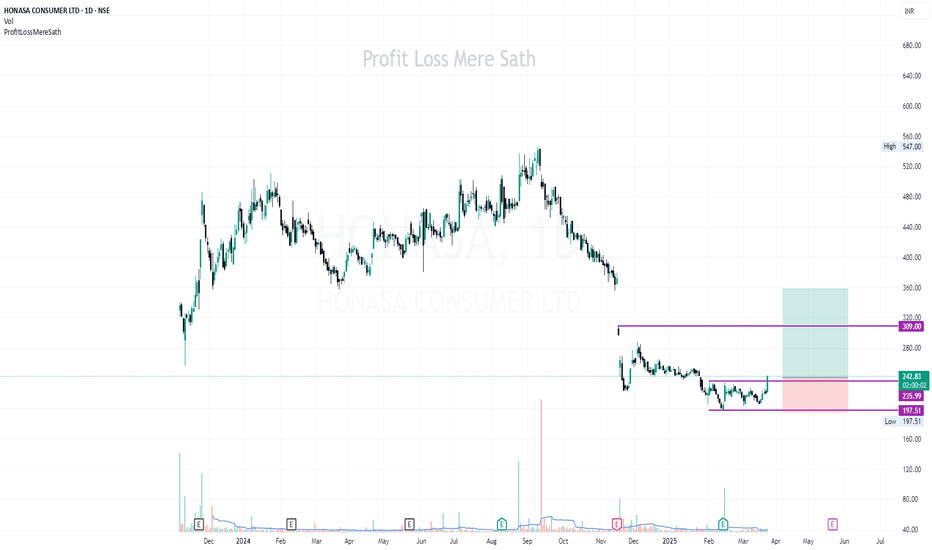

HONASA CONSUMER LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

HONASA | Buy @LTP with Strict SL below 200 | 1st Target 358Disclaimer:

This is not financial advice. Please do your own research or consult with a financial advisor before making any investment decisions. Investments in stocks can be risky and may result in loss of capital.

NLong

HONASA | Buy if close above 236 | SL below 190 | 1st Target 360Disclaimer:

This is not financial advice. Please do your own research or consult with a financial advisor before making any investment decisions. Investments in stocks can be risky and may result in loss of capital.

NLong

Wait for breakoutGood volume buildup in daily as well as in weekly timeframe.

Rising wedge pattern formation.

Fundamentals are OK and improving.

FII & DII stakes are up.

NOTE: I do my analysis, do yours before trade.

NLong

Honasa Consumer LtdHonasa Consumer Ltd If price retraces to the demand zone go long with the setup depicted on the chart.

NLong

NLong

Technical Analysis of HONASA Consumer LtdTechnical Analysis of HONASA Consumer Ltd

Overview of the stock - The chart provides a 1-hour timeframe analysis of HONASA Consumer Ltd (HONASA) on the NSE.

Key Observations during the Technical Analysis of the stock

Price Action: - The stock is currently trading within a consolidation zone b

NLong

HONASA1. Anything can happen.

2. You don't need to know what is going to happen next in order to make money.

3. There is a random distribution between wins and losses for any given set of variables that define an edge. No other thoughts

4. An edge is nothing more than an indication of a higher probability

NLong

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of HONASA is 329.25 INR — it has increased by 19.66% in the past 24 hours. Watch HONASA CONSUMER LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange HONASA CONSUMER LTD stocks are traded under the ticker HONASA.

HONASA stock has risen by 21.94% compared to the previous week, the month change is a 31.93% rise, over the last year HONASA CONSUMER LTD has showed a −22.78% decrease.

We've gathered analysts' opinions on HONASA CONSUMER LTD future price: according to them, HONASA price has a max estimate of 400.00 INR and a min estimate of 197.00 INR. Watch HONASA chart and read a more detailed HONASA CONSUMER LTD stock forecast: see what analysts think of HONASA CONSUMER LTD and suggest that you do with its stocks.

HONASA reached its all-time high on Sep 10, 2024 with the price of 547.00 INR, and its all-time low was 197.50 INR and was reached on Feb 12, 2025. View more price dynamics on HONASA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HONASA stock is 19.31% volatile and has beta coefficient of 0.08. Track HONASA CONSUMER LTD stock price on the chart and check out the list of the most volatile stocks — is HONASA CONSUMER LTD there?

Today HONASA CONSUMER LTD has the market capitalization of 89.57 B, it has increased by 2.99% over the last week.

Yes, you can track HONASA CONSUMER LTD financials in yearly and quarterly reports right on TradingView.

HONASA CONSUMER LTD is going to release the next earnings report on Aug 8, 2025. Keep track of upcoming events with our Earnings Calendar.

HONASA earnings for the last quarter are 0.80 INR per share, whereas the estimation was 0.53 INR resulting in a 52.38% surprise. The estimated earnings for the next quarter are 0.96 INR per share. See more details about HONASA CONSUMER LTD earnings.

HONASA CONSUMER LTD revenue for the last quarter amounts to 5.34 B INR, despite the estimated figure of 5.08 B INR. In the next quarter, revenue is expected to reach 6.26 B INR.

HONASA net income for the last quarter is 249.79 M INR, while the quarter before that showed 260.24 M INR of net income which accounts for −4.02% change. Track more HONASA CONSUMER LTD financial stats to get the full picture.

No, HONASA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. HONASA CONSUMER LTD EBITDA is 685.34 M INR, and current EBITDA margin is 3.32%. See more stats in HONASA CONSUMER LTD financial statements.

Like other stocks, HONASA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade HONASA CONSUMER LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So HONASA CONSUMER LTD technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating HONASA CONSUMER LTD stock shows the strong buy signal. See more of HONASA CONSUMER LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.