Trendline Breakout Navigator [LuxAlgo]The Trendline Breakout Navigator indicator shows three trendlines, representing trends of different significance between Swing Points.

Dots highlight a Higher Low (HL) or Lower High (LH) that pierces through the Trendline without the closing price breaking the Trendline.

A bar color and background color option is included, which offers insights into the price against the trendlines.

🔶 USAGE

Trendlines (TL) are drawn, starting as a horizontal line from a Swing Point.

When an HL (in the case of a bullish TL) or an LH (bearish TL) is found, this Swing Point is connected to the first Swing Point. In both cases, the TL can be optimized when one or more historical close prices breach the TL (see DETAILS).

A solid-styled long-term trendline represents the overall market direction, while a dashed-styled medium-term trendline captures medium-term movements within the long-term trend. Finally, a dotted-styled short-term trendline tracks short-term fluctuations.

🔹 Swing Points vs. Trend

A "Higher High" (HH) or "Lower Low" (LL) will initialize a new trendline, respectively, starting from the previous "Swing Low" or Swing High".

To spot the trend shift, "HH/LL" labels and an optional background color are included. They can be enabled/disabled or set at "Long, Medium, or Short" term TL (Settings—"MS", "HH/LL" and "Background Color").

These features are linked to one Trendline of choice only.

Where the "HH/LL" labels can show a potential trend shift, the background color is:

Green from the moment the close price breaks above a bearish trendline or when an HH occurs

Red from the moment the close price breaks below a bullish trendline or when an LL occurs

🔹 Bar Color

The bar color will depend on the location of the closing price against the three trendlines. When a trendline is unavailable (for example, if the close price breaks the TL and there is no HH/LL), the last known trendline value will be considered.

All three trendlines influence the bar color.

If the close price is above the "Long Term" TL, the bar color will show a gradient of green, darker when the close price is below the "Medium Term" and/or "Short Term" TLs.

On the other hand, when the close price is below the "Long Term" TL, the bar color will show a gradient of red, which becomes darker when the close price is above the "Medium Term" and/or "Short Term" TLs.

To keep the above example simple, only the "Long Term" TL is considered. The white line (not included in the script) resembles the actual value of the TL at each bar, where you can see the effect on the bar color.

Combined with the trendlines and dots, the bar color can provide extra depth and insights into the underlying trends.

🔹 Tested Trendlines

If a new HL/LH pierces the Trendline without the close price breaking the Trendline, the Trendline will be updated.

The exact location where the price exceeded the Trendline is visualized by a dot, colored blue on a bullish trendline and orange when bearish.

These dots can be indicative of a potential trend continuation or reversal.

🔹 Higher TimeFrame Option

The "Period" setting enables users to visualize higher-timeframe trendlines as long as the line length doesn't exceed 5000 bars.

🔶 DETAILS

When a new trendline is drawn, the script first draws a preliminary line and then checks whether a historical close price exceeded this line above (in the case of a bearish TL) or below (in a bullish case).

Subsequently, the most valid point in between is chosen as the starting point of the Trendline.

🔶 SETTINGS

Period: Choose "chart" for trendlines from the current chart timeframe, or choose a higher timeframe

🔹 Swing Length

Toggle and Swing Length for three trendlines: Period used for the swing detection, with higher values returning longer-term Swing Levels.

🔹 Style

Trendline: color for bullish/bearish Trendline

Wick Dot: color for bullish/bearish trendline test

Term: Long-, medium- or short-term

HH/LL: Show HH/LL labels (with or without previous Swing High/Low) of chosen Term

Background Color: Green when the closing price is above the trendline of choice, red otherwise

Bar Color

Indicators and strategies

Uptrick: Z-Score FlowOverview

Uptrick: Z-Score Flow is a technical indicator that integrates trend-sensitive momentum analysi s with mean-reversion logic derived from Z-Score calculations. Its primary objective is to identify market conditions where price has either stretched too far from its mean (overbought or oversold) or sits at a statistically “normal” range, and then cross-reference this observation with trend direction and RSI-based momentum signals. The result is a more contextual approach to trade entry and exit, emphasizing precision, clarity, and adaptability across varying market regimes.

Introduction

Financial instruments frequently transition between trending modes, where price extends strongly in one direction, and ranging modes, where price oscillates around a central value. A simple statistical measure like Z-Score can highlight price extremes by comparing the current price against its historical mean and standard deviation. However, such extremes alone can be misleading if the broader market structure is trending forcefully. Uptrick: Z-Score Flow aims to solve this gap by combining Z-Score with an exponential moving average (EMA) trend filter and a smoothed RSI momentum check, thus filtering out signals that contradict the prevailing market environment.

Purpose

The purpose of this script is to help traders pinpoint both mean-reversion opportunities and trend-based pullbacks in a way that is statistically grounded yet still mindful of overarching price action. By pairing Z-Score thresholds with supportive conditions, the script reduces the likelihood of acting on random price spikes or dips and instead focuses on movements that are significant within both historical and current contextual frameworks.

Originality and Uniquness

Layered Signal Verification: Signals require the fulfillment of multiple layers (Z-Score extreme, EMA trend bias, and RSI momentum posture) rather than merely breaching a statistical threshold.

RSI Zone Lockout: Once RSI enters an overbought/oversold zone and triggers a signal, the script locks out subsequent signals until RSI recovers above or below those zones, limiting back-to-back triggers.

Controlled Cooldown: A dedicated cooldown mechanic ensures that the script waits a specified number of bars before issuing a new signal in the opposite direction.

Gradient-Based Visualization: Distinct gradient fills between price and the Z-Mean line enhance readability, showing at a glance whether price is trading above or below its statistical average.

Comprehensive Metrics Panel: An optional on-chart table summarizes the Z-Score’s key metrics, streamlining the process of verifying current statistical extremes, mean levels, and momentum directions.

Why these indicators were merged

Z-Score measurements excel at identifying when price deviates from its mean, but they do not intrinsically reveal whether the market’s trajectory supports a reversion or if price might continue along its trend. The EMA, commonly used for spotting trend directions, offers valuable insight into whether price is predominantly ascending or descending. However, relying solely on a trend filter overlooks the intensity of price moves. RSI then adds a dedicated measure of momentum, helping confirm if the market’s energy aligns with a potential reversal (for example, price is statistically low but RSI suggests looming upward momentum). By uniting these three lenses—Z-Score for statistical context, EMA for trend direction, and RSI for momentum force—the script offers a more comprehensive and adaptable system, aiming to avoid false positives caused by focusing on just one aspect of price behavior.

Calculations

The core calculation begins with a simple moving average (SMA) of price over zLen bars, referred to as the basis. Next, the script computes the standard deviation of price over the same window. Dividing the difference between the current price and the basis by this standard deviation produces the Z-Score, indicating how many standard deviations the price is from its mean. A positive Z-Score reveals price is above its average; a negative reading indicates the opposite.

To detect overall market direction, the script calculates an exponential moving average (emaTrend) over emaTrendLen bars. If price is above this EMA, the script deems the market bullish; if below, it’s considered bearish. For momentum confirmation, the script computes a standard RSI over rsiLen bars, then applies a smoothing EMA over rsiEmaLen bars. This smoothed RSI (rsiEma) is monitored for both its absolute level (oversold or overbought) and its slope (the difference between the current and previous value). Finally, slopeIndex determines how many bars back the script compares the basis to check whether the Z-Mean line is generally rising, falling, or flat, which then informs the coloring scheme on the chart.

Calculations and Rational

Simple Moving Average for Baseline: An SMA is used for the core mean because it places equal weight on each bar in the lookback period. This helps maintain a straightforward interpretation of overbought or oversold conditions in the context of a uniform historical average.

Standard Deviation for Volatility: Standard deviation measures the variability of the data around the mean. By dividing price’s difference from the mean by this value, the Z-Score can highlight whether price is unusually stretched given typical volatility.

Exponential Moving Average for Trend: Unlike an SMA, an EMA places more emphasis on recent data, reacting quicker to new price developments. This quicker response helps the script promptly identify trend shifts, which can be crucial for filtering out signals that go against a strong directional move.

RSI for Momentum Confirmation: RSI is an oscillator that gauges price movement strength by comparing average gains to average losses over a set period. By further smoothing this RSI with another EMA, short-lived oscillations become less influential, making signals more robust.

SlopeIndex for Slope-Based Coloring: To clarify whether the market’s central tendency is rising or falling, the script compares the basis now to its level slopeIndex bars ago. A higher current reading indicates an upward slope; a lower reading, a downward slope; and similar readings, a flat slope. This is visually represented on the chart, providing an immediate sense of the directionality.

Inputs

zLen (Z-Score Period)

Specifies how many bars to include for computing the SMA and standard deviation that form the basis of the Z-Score calculation. Larger values produce smoother but slower signals; smaller values catch quick changes but may generate noise.

emaTrendLen (EMA Trend Filter)

Sets the length of the EMA used to detect the market’s primary direction. This is pivotal for distinguishing whether signals should be considered (price aligning with an uptrend or downtrend) or filtered out.

rsiLen (RSI Length)

Defines the window for the initial RSI calculation. This RSI, when combined with the subsequent smoothing EMA, forms the foundation for momentum-based signal confirmations.

rsiEmaLen (EMA of RSI Period)

Applies an exponential moving average over the RSI readings for additional smoothing. This step helps mitigate rapid RSI fluctuations that might otherwise produce whipsaw signals.

zBuyLevel (Z-Score Buy Threshold)

Determines how negative the Z-Score must be for the script to consider a potential oversold signal. If the Z-Score dives below this threshold (and other criteria are met), a buy signal is generated.

zSellLevel (Z-Score Sell Threshold)

Determines how positive the Z-Score must be for a potential overbought signal. If the Z-Score surpasses this threshold (and other checks are satisfied), a sell signal is generated.

cooldownBars (Cooldown (Bars))

Enforces a bar-based delay between opposite signals. Once a buy signal has fired, the script must wait the specified number of bars before registering a new sell signal, and vice versa.

slopeIndex (Slope Sensitivity (Bars))

Specifies how many bars back the script compares the current basis for slope coloration. A bigger slopeIndex highlights larger directional trends, while a smaller number emphasizes shorter-term shifts.

showMeanLine (Show Z-Score Mean Line)

Enables or disables the plotting of the Z-Mean and its slope-based coloring. Traders who prefer minimal chart clutter may turn this off while still retaining signals.

Features

Statistical Core (Z-Score Detection):

This feature computes the Z-Score by taking the difference between the current price and the basis (SMA) and dividing by the standard deviation. In effect, it translates price fluctuations into a standardized measure that reveals how significant a move is relative to the typical variation seen over the lookback. When the Z-Score crosses predefined thresholds (zBuyLevel for oversold and zSellLevel for overbought), it signals that price could be at an extreme.

How It Works: On each bar, the script updates the SMA and standard deviation. The Z-Score is then refreshed accordingly. Traders can interpret particularly large negative or positive Z-Score values as scenarios where price is abnormally low or high.

EMA Trend Filter:

An EMA over emaTrendLen bars is used to classify the market as bullish if the price is above it and bearish if the price is below it. This classification is applied to the Z-Score signals, accepting them only when they align with the broader price direction.

How It Works: If the script detects a Z-Score below zBuyLevel, it further checks if price is actually in a downtrend (below EMA) before issuing a buy signal. This might seem counterintuitive, but a “downtrend” environment plus an oversold reading often signals a potential bounce or a mean-reversion play. Conversely, for sell signals, the script checks if the market is in an uptrend first. If it is, an overbought reading aligns with potential profit-taking.

RSI Momentum Confirmation with Oversold/Overbought Lockout:

RSI is calculated over rsiLen, then smoothed by an EMA over rsiEmaLen. If this smoothed RSI dips below a certain threshold (for example, 30) and then begins to slope upward, the indicator treats it as a potential sign of recovering momentum. Similarly, if RSI climbs above a certain threshold (for instance, 70) and starts to slope downward, that suggests dwindling momentum. Additionally, once RSI is in these zones, the indicator locks out repetitive signals until RSI fully exits and re-enters those extreme territories.

How It Works: Each bar, the script measures whether RSI has dropped below the oversold threshold (like 30) and has a positive slope. If it does, the buy side is considered “unlocked.” For sell signals, RSI must exceed an overbought threshold (70) and slope downward. The combination of threshold and slope helps confirm that a reversal is genuinely in progress instead of issuing signals while momentum remains weak or stuck in extremes.

Cooldown Mechanism:

The script features a custom bar-based cooldown that prevents issuing new signals in the opposite direction immediately after one is triggered. This helps avoid whipsaw situations where the market quickly flips from oversold to overbought or vice versa.

How It Works: When a buy signal fires, the indicator notes the bar index. If the Z-Score and RSI conditions later suggest a sell, the script compares the current bar index to the last buy signal’s bar index. If the difference is within cooldownBars, the signal is disallowed. This ensures a predefined “quiet period” before switching signals.

Slope-Based Coloring (Z-Mean Line and Shadow):

The script compares the current basis value to its value slopeIndex bars ago. A higher reading now indicates a generally upward slope, while a lower reading indicates a downward slope. The script then shades the Z-Mean line in a corresponding bullish or bearish color, or remains neutral if little change is detected.

How It Works: This slope calculation is refreshingly straightforward: basis – basis . If the result is positive, the line is colored bullish; if negative, it is colored bearish; if approximately zero, it remains neutral. This provides a quick visual cue of the medium-term directional bias.

Gradient Overlays:

With gradient fills, the script highlights where price stands in relation to the Z-Mean. When price is above the basis, a purple-shaded region is painted, visually indicating a “bearish zone” for potential overbought conditions. When price is below, a teal-like overlay is used, suggesting a “bullish zone” for potential oversold conditions.

How It Works: Each bar, the script checks if price is above or below the basis. It then applies a fill between close and basis, using distinct colors to show whether the market is trading above or below its mean. This creates an immediate sense of how extended the market might be.

Buy and Sell Labels (with Alerts):

When a legitimate buy or sell condition passes every check (Z-Score threshold, EMA trend alignment, RSI gating, and cooldown clearance), the script plots a corresponding label directly on the chart. It also fires an alert (if alerts are set up), making it convenient for traders who want timely notifications.

How It Works: If rawBuy or rawSell conditions are met (refined by RSI, EMA trend, and cooldown constraints), the script calls the respective plot function to paint an arrow label on the chart. Alerts are triggered simultaneously, carrying easily recognizable messages.

Metrics Table:

The optional on-chart table (activated by showMetrics) presents real-time Z-Score data, including the current Z-Score, its rolling mean, the maximum and minimum Z-Score values observed over the last zLen bars, a percentile position, and a short-term directional note (rising, falling, or flat).

Current – The present Z-Score reading

Mean – Average Z-Score over the zLen period

Min/Max – Lowest and highest Z-Score values within zLen

Position – Where the current Z-Score sits between the min and max (as a percentile)

Trend – Whether the Z-Score is increasing, decreasing, or flat

Conclusion

Uptrick: Z-Score Flow offers a versatile solution for traders who need a statistically informed perspective on price extremes combined with practical checks for overall trend and momentum. By leveraging a well-defined combination of Z-Score, EMA trend classification, RSI-based momentum gating, slope-based visualization, and a cooldown mechanic, the script reduces the occurrence of false or premature signals. Its gradient fills and optional metrics table contribute further clarity, ensuring that users can quickly assess market posture and make more confident trading decisions in real time.

Disclaimer

This script is intended solely for informational and educational purposes. Trading in any financial market comes with substantial risk, and there is no guarantee of success or the avoidance of loss. Historical performance does not ensure future results. Always conduct thorough research and consider professional guidance prior to making any investment or trading decisions.

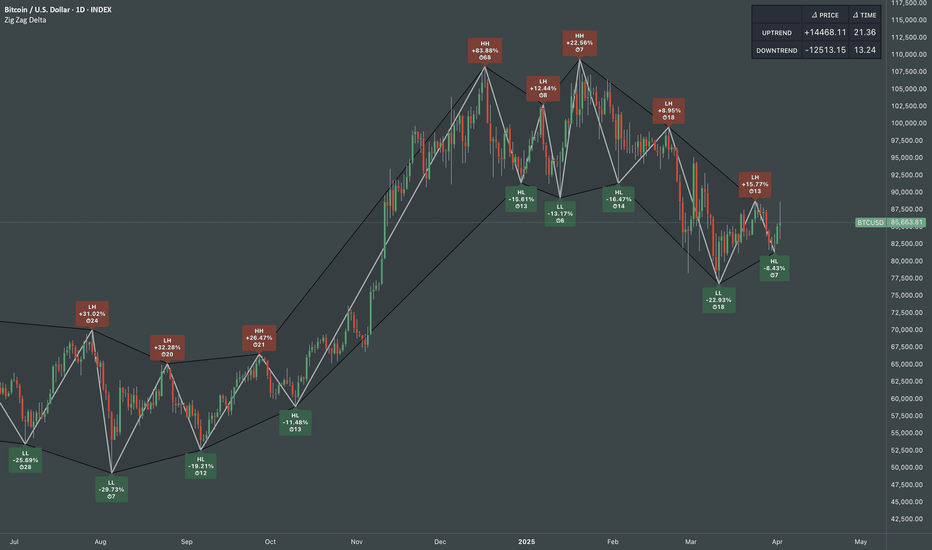

Zig Zag Trend Metrics“ Zig Zag Trend Metrics ” is a highly versatile indicator, built on the classic Zig Zag concept and thoughtfully designed for technical traders seeking a deeper, more structured view of market dynamics. This tool identifies significant swing highs and lows, classifies them, and annotates each with key metrics, offering a precise snapshot of each movement. It enhances visual analysis by drawing connecting lines that outline the flow of market structure, making trend progression and reversals instantly recognizable. Beyond visual mapping, it features a compact, real-time statistics table that calculates the average price and time deltas for both bullish and bearish swings, giving traders deep insights into trend momentum and rhythm. With extensive customization options, this indicator adapts seamlessly to vast trading styles or chart setups, empowering traders to spot patterns, evaluate trend strength, and make more confident, data-backed decisions.

❖ FEATURES

✦ Automatic Swing Detection

At its core, this indicator automatically identifies swing highs and lows based on a customizable lookback period (default: 10 bars).

✦ Labeling Swing Points

Each swing is visualized with a label that includes:

Swing Classification : “HH” (Higher High), “LH” (Lower High), “LL” (Lower Low), or “HL” (Higher Low).

Price Difference : Displayed in percentage or absolute value from the previous opposite swing.

Time Difference : The number of bars since the previous swing of the opposite type.

These labels offer traders clear, immediate insight into price movements and structural changes.

✦ Visual Lines

The indicator draws three types of lines:

Bullish Lines: Connect recent swing lows to new swing highs, indicating uptrends.

Bearish Lines: Connect recent swing highs to new swing lows, indicating downtrends.

Range Lines: Connect consecutive highs or lows to outline price channels.

Each line type can be color-coded and customized for visibility.

✦ Statistics Table

An on-screen metrics table provides a live summary of trends. Script uses Relative Averaging to smooth price and time changes. This prevents outliers from distorting the data and provides a more reliable sense of typical swing behavior.

Uptrend Metrics: Shows average price and time differences from recent bullish swings.

Downtrend Metrics: Shows the same for bearish swings.

🛠️ Customization Options

Ability to tailor the indicator to suit their strategy and aesthetic preferences:

Swing Period: Adjust sensitivity to short- or long-term swings.

Color Settings: Customize line and label colors.

Label Display: Choose between absolute or percentage price differences.

Table Settings: Modify size, location, or visibility.

This makes the indicator highly flexible and useful across various timeframes and assets.

Pro Scalper AI [BullByte]The Pro Scalper AI is a powerful, multi-faceted scalping indicator designed to assist active traders in identifying short-term trading opportunities with precision. By combining trend analysis, momentum indicators, dynamic weighting, and optional AI forecasting, this tool provides both immediate and latched trading signals based on confirmed (closed bar) data—helping to avoid repainting issues. Its flexible design includes customizable filters such as a higher timeframe trend filter, and adjustable settings for ADX, ATR, and Hull Moving Average (HMA), giving traders the ability to fine-tune the strategy to different markets and timeframes.

Key Features :

- Confirmed Data Processing :

Utilizes a helper function to lock in price and volume data only from confirmed (closed) bars, ensuring the reliability of signals without the risk of intrabar repainting.

- Trend Analysis :

Employs ADX and Directional Movement (DI) calculations along with a locally computed HMA to detect short-term trends. An optional higher timeframe trend filter can further refine the analysis.

- Flexible Momentum Modes :

Choose between three momentum calculation methods—Stochastic RSI, Fisher RSI, or Williams %R—to match your preferred style of analysis. This versatility allows you to optimize the indicator for different market conditions.

- Dynamic Weighting & Volatility Adjustments :

Adjusts the contribution of trend, momentum, volatility, and volume through dynamic weighting. This ensures that the indicator responds appropriately to varying market conditions by scaling its sensitivity with user-defined maximum factors.

- Optional AI Forecast :

For those who want an extra edge, the built-in AI forecasting module uses linear regression to predict future price moves and adjusts oscillator thresholds accordingly. This feature can be toggled on or off, with smoothing options available for more stable output.

- Latching Mode for Signal Persistenc e:

The script features a latching mechanism that holds signals until a clear reversal is detected, preventing whipsaws and providing more reliable trade entries and exits.

- Comprehensive Visualizations & Dashboard :

- Composite Oscillator & Dynamic Thresholds : The oscillator is plotted with dynamic upper and lower thresholds, and the area between them is filled with a color that reflects the active trading signal (e.g., Strong Buy, Early Sell).

- Signal Markers : Both immediate (non-latching) and stored (latched) signals are marked on the chart with distinct shapes (circles, crosses, triangles, and diamonds) to differentiate between signal types.

- Real-Time Dashboard : A customizable dashboard table displays key metrics including ADX, oscillator value, chosen momentum mode, HMA trend, higher timeframe trend, volume factor, AI bias (if enabled), and more, allowing traders to quickly assess market conditions at a glance.

How to Use :

1. S ignal Interpretation :

- Immediate Signals : For traders who prefer quick entries, the indicator displays immediate signals such as “Strong Buy” or “Early Sell” based on the current market snapshot.

- Latched Signals : When latching is enabled, the indicator holds a signal state until a clear reversal is confirmed, offering sustained trade setups.

2. Trend Confirmation :

- Use the HMA trend indicator and the optional higher timeframe trend filter to confirm the prevailing market direction before acting on signals.

3. Dynamic Thresholds & AI Forecasting :

- Monitor the dynamically adjusted oscillator thresholds and, if enabled, the AI bias to gauge potential shifts in market momentum.

4. Risk Management :

- Combine these signals with additional analysis and sound risk management practices to determine optimal entry and exit points for scalping trades.

Disclaimer :

This script is provided for educational and informational purposes only and does not constitute financial advice. Trading involves risk, and past performance is not indicative of future results. Always perform your own analysis and use proper risk management strategies before trading.

Fancy as Fuck Moving Averages [PQ_MOD] [v0.1.4]This advanced multi-timeframe indicator provides a comprehensive suite of moving average calculations and visual tools for trend analysis and trade signal generation. It supports a wide range of moving average types—from classic SMA, EMA, and WMA to more sophisticated variants like ALMA, JMA, and FRAMA—allowing users to customize parameters such as periods, offsets, and smoothing factors. The script plots these moving averages across intraday, daily, weekly, and monthly timeframes, with options to overlay dynamic cloud fills that visually highlight the relationship between faster and slower averages for an immediate trend confirmation. Additionally, it integrates an ATR-based mechanism to define upper and lower trend boundaries and automatically generate buy and sell signals when trends reverse, complete with customizable alert conditions. This flexible design ensures traders have both the detailed analytical tools and clear visual cues needed for effective market analysis.

BIN Based Support and Resistance [SS]This indicator presents a version of an alternative way to determine support and resistance, using a method called "Bins".

Bins provide for a flexible and interesting way to determine support and resistance levels.

First off, let's discuss BINS:

Bins are ranges or containers into which your data points can be sorted. For example, if you're grouping ages, you might have bins like 0–18, 19–35, 36–50, and 51+. Any data point within these intervals gets placed in the corresponding bin.

Binning simplifies complex data sets by grouping values into categories. This is useful for such things as

Visualizing data in histograms or bar charts.

Reducing noise and highlighting trends.

This indicator groups the price action into 10 separate bins. It determines the Support / Resistance level by averaging the values in the Bins to find an iteration of the "central tendency" or average reoccurring value.

Pros and Cons

Since this is a different approach to support and resistance, I think its important to highlight some of the pros and advantages, but also be open about the cons.

First off the PROS

Bin Based Support and Resistance Levels dynamically adjust to ranges as opposed to hard / fast peaks and valleys. This makes them better at analyzing price action vs simply drawing lines at random peaks and valleys.

Because Bins are analyzing ALL PA within a period's max and min range, Bin Support and Resistance can actually be used similar to Volume profile, where you are able to identify a pseudo-POC, or areas where price tends to consolidate. Take a look at this example on SPY:

You can see these 2 SR lines are close together. This represents that this general price range is an area where price likes to accumulate/consolidate. You can see the SPY ended up coming back to this range and consolidating there for a bit.

This is a strength of using a BIN based approach to calculating support and resistance, because as indicated before, it looks at price action vs peaks and valleys.

As a tip, these areas are areas you want to wait for a break in one direction or the other.

The indicator provides for backtest results of the support and resistance lines, to see how many times certain areas acted as resistance or support. Because this is analyzing and distributing PA evenly throughout the period's max and min, the indicator can tell you which areas tend to have higher rejection zones and which have higher support zones.

Now the CONS

Because bin based SR take an average approach, the SR lines can sometimes be slightly broken before the ticker finds rejection:

To combat this, make sure there is confirmed support. How the indicator actually backtests these lines is by waiting to see if the ticker has 3 consecutive closes above the support line or below the resistance line. So these are things to be mindful of.

It doesn't consider pivots. Most support and resistance indicators either identify max and min peaks and valleys or use pivot points. Pivot points are a great way to identify peaks and valleys and thus by extension support and resistance. However, this is also somewhat of a strength, as using BINS forces the indicator to consider ALL price action and not just the extremes (highs and lows).

Can be slightly skewed in highly volatile environments. Any time there is a massive drop or rally, it can skew the indicator to give extreme ranges to both ends. For example, the Tariff news collapse on ES1!:

Owning to limitations in lookback length, sometimes the min and max range can be exceeded and other traditional areas of support / resistance is where a ticker will find support.

Using the indicator

Here are some basic use/functionalities of the indicator:

Selecting display of backtest results: You can select to have the backtest results shown in a table:

Or directly on the lines:

Inversely, you can toggle them off completely:

You can modify the lookback length. The suggested lookback length is between 250 to 500 candles on smaller timeframes. I also suggest 252 on daily timeframes (which represents 1 trading year).

And that's the indicator!

It is very easy to use, so you should pick it up in no time!

Enjoy and as always, 🚀🚀 safe trades! 🚀🚀

Pearson Correlation [Mr_Rakun] Pearson Correlation

This script calculates the Pearson correlation coefficient (r) between the closing price of the current asset and another selected asset.

🔍 How It Works:

• The user selects a correlation period (default: 20) and a symbol (default: ETH/USDT).

• The script retrieves the closing prices of both assets.

• The Pearson correlation formula is applied:

r = \frac{n(\sum xy) - (\sum x)(\sum y)}{\sqrt{ }}

• The correlation is plotted as a histogram:

• +1 (green line) → Perfect positive correlation

• -1 (red line) → Perfect negative correlation

• 0 (gray line) → No correlation

📊 Why Use This?

This indicator helps traders identify relationships between assets, such as whether two markets move together or inversely. It is useful for hedging strategies, portfolio diversification, and market comparisons.

Sentiment Master Oscillator[BullByte]

The Sentiment Master Oscillator is a modern market sentiment indicator designed for traders seeking to identify early trend shifts and potential reversals with clarity. This oscillator combines multiple technical tools—RSI, MACD, EMAs, ADX, ATR, and volume filters—to deliver layered signals that help you assess market momentum in a clear and simplified manner.

Key Features:

- Multi-Indicator Approach :

Integrates RSI (with a smoothing function), MACD, and two EMAs to gauge momentum and trend direction. The oscillator also includes ADX and ATR filters to ensure that only markets with sufficient directional strength and volatility generate signals.

- Dynamic Signal Zones :

The oscillator produces a raw value ranging roughly from -3 to +3 (adjustable via a scaling factor). Positive readings suggest bullish conditions, while negative readings indicate bearish trends. Visual zones (Early, Confirmed, Strong) are clearly marked with color-coded horizontal lines to help you interpret the strength of the signal at a glance.

- Adaptive Smoothing :

For those who prefer quicker, more responsive signals (ideal for scalping), an adaptive smoothing option is available. When enabled, it applies a shorter smoothing period to the oscillator; otherwise, a more conservative base period is used.

- Reversal Alerts :

Yellow dots are plotted on the chart to highlight potential reversal points. These alerts are triggered when the oscillator crosses specific thresholds, coupled with volume and ATR conditions, signaling that a top or bottom may be forming.

- Customizable Filters :

- ATR Filter :Ensures that the market's volatility is above a set threshold before signaling.

- ADX Filter :Confirms sufficient trend strength.

- Volume Filter : Requires that trading volume surges above a multiple of its simple moving average, filtering out low-volume noise.

- Clear Signal Messaging :

Based on the combined signals from various indicators, the script categorizes market sentiment into actionable messages such as "Early Buy", "Confirmed Buy", "Strong Buy", "Early Sell", "Confirmed Sell", and "Strong Sell". A "Grey Zone" label is used when the oscillator is near neutral, indicating that no clear trend is present.

How to Use :

1. Entry and Exit Decisions : Use the different signal stages (Early, Confirmed, Strong) as guides for your entries and exits.

2. Trend Confirmation : Rely on the multi-indicator setup for added confirmation of prevailing market conditions before executing trades.

3. Reversal Cues : Pay attention to the reversal dots for potential turning points in the market, which can be used to adjust positions or initiate trades.

Disclaimer:

This indicator is intended for educational and informational purposes only. It should not be taken as financial advice. Always use appropriate risk management and combine it with your analysis before making any trading decisions. Past performance is not indicative of future results.

By adhering to TradingView's publishing guidelines, the BullByte Sentiment Master is designed to provide transparency, simplicity, and robust analysis tools to enhance your trading strategy. Enjoy a clearer view of market sentiment and make more informed trading decisions!

CISD with Alerts [neo|]█ OVERVIEW

CISD (or Change in State of Delivery) is an ICT concept and reversal pattern which may allow traders to identify reversals or changes in market structure early, compared to using traditional market structure. This script aims to correctly identify, and update these levels and provide alerts, so that traders can take advantage of this concept with ease.

█ CONCEPTS

Simply put, CISD may be identified when price closes above the open of the candle which started the most recent downtrend or liquidity sweep. Generally, it is most powerful when applied to key points in the market as a confirmation from where you may want price to reverse.

For example, when price is in a downtrend, we take the open of the last consecutive downwards candle and observe the CISD once price closes above it, beginning an uptrend.

Examples:

COMEX:GC1!

CME_MINI:NQ1!

█ How to use

To use the indicator, simply apply it to your chart and modify any of your desired inputs.

• Bullish CISD color allows you to change the color of +CISD levels.

• Bearish CISD color allows you to change the color of -CISD levels.

• Line width allows you to modify the width of +-CISD lines.

• Line extension bars allows you to change how far ahead CISD levels are drawn (by default it is 5).

• Keep old CISD levels will allow you to preserve all past CISD levels if you would like to observe the logic.

• Enable stat table will let you add a table on your chart which will tell you the current CISD trend, as well as your ticker and timeframe.

• Table position allows you to customize where the table will appear on your chart.

Multi-Timeframe S/R & Breakout Projectionfinds nearby key support and resistance lines, and check for fake and real brake outs

Multi-timeframe Trend & Momentum DashboardMulti-Timeframe Trend & Momentum Dashboard

This indicator is a comprehensive multi-timeframe analysis tool designed for traders who want to quickly assess market trends and momentum across several timeframes. It combines trend detection with duration tracking and displays key information in an easy-to-read on-chart table. Key features include:

Multi-Timeframe Analysis:

Analyzes nine different timeframes (from 1-minute up to 1-week) simultaneously, helping you gauge the overall market trend at a glance.

Trend Detection & Duration:

Uses a combination of a short-term EMA and a long-term SMA to determine whether the market is bullish, bearish, or neutral. It also tracks how long the current trend has persisted in terms of consecutive bars and displays this duration next to each timeframe.

RSI Display & Visual Alerts:

Calculates the RSI for each timeframe. RSI values are color-coded—green when above 50 (indicating bullish momentum) and red when below 50 (indicating bearish conditions). Additionally, if the market is bearish on a particular timeframe while the RSI is above 50, the RSI cell flashes yellow to alert you of a potential trend reversal or divergence.

On-Chart Trend Start Markers:

When a new trend is detected on your current chart’s timeframe, the indicator automatically marks the bar with a label showing the new trend direction, providing a clear visual cue for trend changes.

This powerful tool is perfect for traders looking to combine multi-timeframe trend analysis with momentum indicators, enabling a more informed and dynamic trading strategy. Whether you’re a day trader or swing trader, the Multi-Timeframe Trend & Momentum Dashboard brings clarity to market conditions across multiple time horizons.

SUPeR TReND 2.718An evolved version of the classic Supertrend, SUPeR TReND 2.718 is built to deliver elegant, high-precision trend detection using Euler's constant (e = 2.718) as its default multiplier. Designed for clarity and visual flow, this indicator brings together smooth line work, intelligent color logic, and a minimalistic tally system that tracks trend persistence — all in a highly customizable, overlay-ready format.

Unlike traditional implementations, this version maintains line visibility regardless of fill opacity, ensuring crisp tracking even in complex environments. Ideal for traders who value both aesthetics and actionable structure.

__________________________________________________________

🔑 Key Features:

- 📐 ATR-based Supertrend with default multiplier = e (2.718)

- 📉 Dynamic trend line with optional fill beneath price

- ⏳ Trend duration tally label (count-only or full format)

- ⬆️ Higher-timeframe Supertrend overlay (optional)

- 🟢 Directional candle coloring for clarity

- 🟡 Subtle anchor line to guide perception without clutter

- ⚙️ PineScript v6 compliant, efficient and modular

__________________________________________________________

🧠 Interpretation Guide:

- The Supertrend line tracks trend support or resistance — beneath price in uptrends, above in downtrends.

- The shaded fill reflects direction with 70% transparency.

- The trend tally label counts how long the current trend has lasted.

- Candle colors confirm direction without overtaking price action.

- The optional HTF line shows higher-timeframe context.

- A soft yellow anchor line stabilizes the fill relationship without distraction.

__________________________________________________________

⚙️ Inputs & Controls:

- ✏️ ATR Length – Volatility lookback

- 🧮 Multiplier – Default = 2.718 (Euler's number)

- 🕰️ Higher Timeframe – Choose your bias frame

- 👁️ Show HTF / Main – Toggle each trend layer

- 🧾 Show Label / Simplify – Show trend duration, with or without arrows

- 🎨 Color Candles – Turn directional bar coloring on or off

- 🪄 Show Fill – Toggle the shaded visual rhythm

- 🎛️ All visuals use tuned colors and transparencies for clarity

__________________________________________________________

🚀 Best Practices:

- ✅ Works on any time frame; shines on 1h v. 1D

- 🔁 Use the HTF line for macro bias filtering

- 📊 Combine with volume or liquidity overlays for edge

- 🧱 Use as a structural base layer with minimalist stacks

__________________________________________________________

📈 Strategy Tips:

- 🧭 MTF Trend Alignment: Enable the HTF line to filter trades. If the HTF trend is up, only take longs on the lower frame, and vice versa.

- 🔁 Pullback Entries: During a strong trend, consider short-term dips below the Supertrend line as possible re-entry zones — only if HTF remains aligned.

- ⏳ Tally for Exhaustion: When the bar count exceeds 15+, look for confluence (volume divergence, key levels, reversal signals).

- ⚠️ HTF Flip + Extended Trend: When the HTF trend reverses while the main trend is extended, that may be a macro exit or fade signal.

- 🚫 Solo Mode: Disable HTF and use the main trend + tally as a standalone signal layer.

- 🧠 Swing Setup Friendly: Especially powerful on 1D or 1h in swing systems or trend-based grid strategies.

Swing Structure + Session Sweeps“Scalper-Friendly Trend & Sweep Detector”

Swing Structure + Session Sweeps with TEMA Cloud

This powerful all-in-one tool is designed for intraday traders, swing traders, and scalpers who want to spot high-probability reversals, trend continuations, and liquidity sweeps with confluence.

🔹 Core Features

Multi-layered TEMA Cloud (9, 20, 34, 50) for clear trend structure

Dynamic Bull/Bear labels when the trend flips

Centerline for TEMA 20 to visualize core trend direction

Session-based liquidity sweep detection (Asia, London, NY)

Volume and absorption dots to catch hidden pressure

Swing high/low detection (external and internal)

Visual VWAP, daily highs/lows, and customizable session zones

Optional alerts for volume spikes, absorption, and reversal sweeps

📈 Use it to:

Confirm directional bias

Anticipate pullbacks and breakouts

Identify volume-backed reversals

Align trades with session strength and swing confluence

⚙️ Built for scalpers, intraday opportunists, and precision chartists alike.

M2 for BTC [CryptoSoldier]Global M2 Liquidity design specially for BITCOIN with an Offset of 75 bars by Default

Today's Daily LevelsTrack daily price action like a pro with instant visibility of key levels, percentages, and P&L values - all in one clean view.

• Shows Daily Open, High, Low & Median levels

• Dynamic color-coding: green above open, red below

• Real-time price labels with:

Exact price levels

% distance between levels

Point values

Dollar values per contract

• Auto-repaints on timeframe changes

• 30min alerts for median crosses

Double MACD Overlay [NLR]This indicator plots two MACD signals directly on your price chart to help you spot trends and shifts in momentum more clearly:

🔹 Main MACD - The classic MACD with customizable Fast, Slow, and Signal lengths. Great for confirming broader trend direction.

🔹 Short MACD - A faster MACD with an option to smooth the input, helping you catch early signals or identify short-term momentum changes.

Each MACD is visualized as:

A line showing the moving average

A colored histogram showing the MACD minus the signal

A zero line for reference

Why use this?

By comparing a short-term MACD with a longer-term one, you get early signals without losing the big picture. Use it for confirmation, divergence spotting, or just cleaner trend visualization.

Best For:

✅ Trend-followers

✅ Momentum traders

✅ Anyone who wants more context from their MACD signals

Recommended Settings:

Here are some ideal settings to get the most out of this indicator:

On a 5-Minute Chart:

Compare your current MACD with the 15-minute MACD.

- MACD Multiplier: 3

On a 1-Minute Chart:

Spot short-term moves while comparing them to the 5-minute MACD.

- MACD Multiplier: 5

- Use Smoothed Source (Short MACD): ON (for a cleaner short MACD signal)

Happy trading! 💹

Vertical Line at Specified HoursThis script helps you easily separate time.

This indicator can be used for many different purposes. For example, I use it to separate different days and sessions.

Features :

1- Ability to use 10 vertical lines simultaneously

2- The Possibility to change the color of lines

3- The Possibility to change the line type

Tip : The times you enter in the input section must be in the New York time zone.

Range Detector [PQ_MOD]This multi-functional Range Detector indicator dynamically identifies and visualizes significant price ranges and predictive zones by combining traditional range analysis with advanced market structure concepts. Initially, it computes a baseline range using a moving average and an ATR-derived threshold over a user-defined period; if the price remains within this range for the specified number of bars, the indicator draws and continuously updates a range box and corresponding average line. Simultaneously, it calculates predictive range levels—upper and lower bounds derived from an extended ATR window and multiplier—to project potential future price boundaries. Beyond simple range detection, the script incorporates a comprehensive suite of market structure tools by detecting swing highs/lows, order blocks, fair value gaps, and premium/discount zones, and it supports multi-timeframe analysis with customizable visual styles, labels, and alerts. This robust design enables traders to monitor real-time market structure and range dynamics, providing clear visual cues and automated alerts for significant breakout or reversal events.

Piorun-ZEUS Setup AutoDetects market structure and generates LONG or SHORT signals

The script analyzes market structure based on predefined conditions (e.g., trendline break, BOS, CHOCH, OB, FVG, candlestick patterns).

When all conditions of your strategy are met (trend, structure, candle pattern, FVG, OB) — the script automatically displays an Entry signal for LONG (buy) or SHORT (sell).

It does not react to random moves — the signal will only appear when all the key criteria are fulfilled.

Automatically draws Entry, SL, TP1, TP2, TP3 levels on the chart

After detecting a valid setup, the script plots the exact levels:

Entry – suggested entry price

SL (Stop Loss) – level to protect against loss

TP1, TP2, TP3 (Take Profit) – target levels to secure profits (minimum RRR 1:3)

✅ Once a trade is opened, these levels are marked on the chart so you can clearly see your targets and risk.

Creates alerts in TradingView for both directions (LONG & SHORT)

The script generates alert signals in TradingView, so you will be notified when a valid trading setup appears — whether it's a buy (LONG) or sell (SHORT) opportunity.

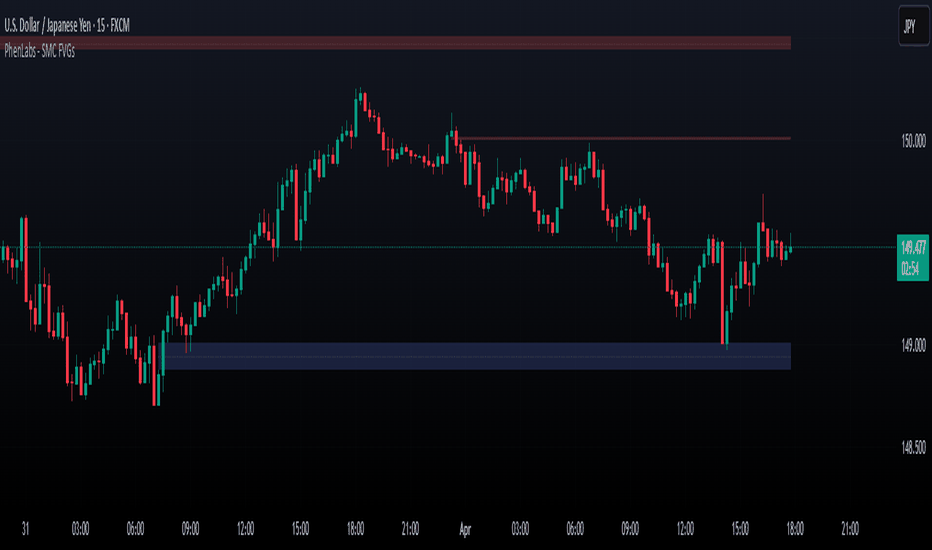

Smarter Money Concepts - FVGs [PhenLabs]📊 Smarter Money Concepts - FVGs

Version: PineScript™ v6

📌 Description

Smarter Money Concepts - FVGs is a sophisticated indicator designed to identify and track Fair Value Gaps (FVGs) in price action. These gaps represent market inefficiencies where price moves quickly, creating imbalances that often attract subsequent price action for mitigation. By highlighting these key areas, traders can identify potential zones for reversals, continuations, and price targets.

The indicator employs volume filtering ideology to highlight only the most significant FVGs, reducing noise and focusing on gaps formed during periods of higher relative volume. This combination of price structure analysis and volume confirmation provides traders with high-probability areas of interest that institutional smart money may target during future price movements.

🚀 Points of Innovation

Volume-Filtered Gap Detection : Eliminates low-significance FVGs by requiring a minimum volume threshold, focusing only on gaps formed with institutional participation

Equilibrium Line Visualization : Displays the midpoint of each gap as a potential precision target for trades

Automated Gap Mitigation Tracking : Monitors when price revisits and mitigates gaps, automatically managing visual elements

Time-Based Gap Management : Intelligently filters gaps based on a configurable timeframe, maintaining chart clarity

Dual Direction Analysis : Simultaneously tracks both bullish and bearish gaps, providing a complete market structure view

Memory-Optimized Design : Implements efficient memory management for smooth chart performance even with numerous FVGs

🔧 Core Components

Fair Value Gap Detection : Identifies price inefficiencies where the current candle’s low is higher than the previous candle’s high (bearish FVG) or where the current candle’s high is lower than the previous candle’s low (bullish FVG).

Volume Filtering Mechanism : Calculates relative volume compared to a moving average to qualify only gaps formed during significant market activity.

Mitigation Tracking : Continuously monitors price action to detect when gaps get filled, with options to either hide or maintain visual representation of mitigated gaps.

🔥 Key Features

Customizable Gap Display : Toggle visibility of bullish and bearish gaps independently to focus on your preferred market direction

Volume Threshold Control : Adjust the minimum volume ratio required for gap qualification, allowing fine-tuning between sensitivity and significance

Flexible Mitigation Methods : Choose between “Wick” or “Close” methods for determining when a gap has been mitigated, adapting to different trading styles

Visual Customization : Full control over colors, transparency, and style of gap boxes and equilibrium lines

🎨 Visualization

Gap Boxes : Rectangular highlights showing the exact price range of each Fair Value Gap. Bullish gaps indicate potential upward price targets, while bearish gaps show potential downward targets.

Equilibrium Lines : Dotted lines running through the center of each gap, representing the mathematical midpoint that often serves as a precision target for price movement.

📖 Usage Guidelines

General Settings

Days to Analyze : Default: 15, Range: 1-100. Controls how many days of historical gaps to display, balancing between comprehensive analysis and chart clarity

Visual Settings

Bull Color : Default:(#596fd33f). Color for bullish Fair Value Gaps, typically using high transparency for clear chart visibility

Bear Color : Default:(#d3454575). Color for bearish Fair Value Gaps, typically using high transparency for clear chart visibility

Equilibrium Line : Default: Enabled. Toggles visibility of the center equilibrium line for each FVG

Eq. Line Color : Default: Black with 99% transparency. Sets the color of equilibrium lines, usually kept subtle to avoid chart clutter

Eq. Line Style : Default: Dotted, Options: Dotted, Solid, Dashed. Determines the line style for equilibrium lines

Mitigation Settings

Mitigation Method : Default: Wick, Options: Wick, Close. Determines how gap mitigation is calculated - “Wick” uses high/low values while “Close” uses open/close values for more conservative mitigation criteria

Hide Mitigated : Default: Enabled. When enabled, gaps become transparent once mitigated, reducing visual clutter while maintaining historical context

Volume Filter

Volume Filter : Default: Enabled. When enabled, only shows gaps formed with significant volume relative to recent average

Min Ratio : Default: 1.5, Range: 0.1-10.0. Minimum volume ratio compared to average required to display an FVG; higher values filter out more gaps

Periods : Default: 15, Range: 5-50. Number of periods used to calculate the average volume baseline

✅ Best Use Cases

Identifying potential reversal zones where price may react after extended moves

Finding precise targets for take-profit placement in trend-following strategies

Detecting institutional interest areas for potential breakout or breakdown confirmations

Plotting significant support and resistance zones based on structural imbalances

Developing fade strategies at key market structure points

Confirming trade entries when price approaches significant unfilled gaps

⚠️ Limitations

Works best on higher timeframes where gaps reflect more significant market inefficiencies

Very choppy or ranging markets may produce small gaps with limited predictive value

Volume filtering depends on accurate volume data, which may be less reliable for some symbols

Performance may be affected when displaying a very large number of historical gaps

Some gaps may never be fully mitigated, particularly in strongly trending markets

💡 What Makes This Unique

Volume Intelligence : Unlike basic FVG indicators, this script incorporates volume analysis to identify the most significant structural imbalances, focusing on quality over quantity.

Visual Clarity Management : Automatic handling of mitigated gaps and memory management ensures your chart remains clean and informative even over extended analysis periods.

Dual-Direction Comprehensive Analysis : Simultaneously tracks both bullish and bearish gaps, providing a complete market structure picture rather than forcing a directional bias.

🔬 How It Works

1. Gap Detection Process :

The indicator examines each candle in relation to previous candles, identifying when a gap forms between the low of candle and high of candle (bearish FVG) or between the high of candle and low of candle (bullish FVG). This specific candle relationship identifies true structural imbalances.

2. Volume Qualification :

For each potential gap, the algorithm calculates the relative volume compared to the configured period average. Only gaps formed with volume exceeding the minimum ratio threshold are displayed, ensuring focus on institutionally significant imbalances.

3. Equilibrium Calculation :

For each qualified gap, the script calculates the precise mathematical midpoint, which becomes the equilibrium line - a key target that price often gravitates toward during mitigation attempts.

4. Mitigation Tracking :

The indicator continuously monitors price action against existing gaps, determining mitigation based on the selected method (wick or close). When price reaches the equilibrium point, the gap is considered mitigated and can be visually updated accordingly.

💡 Note:

Fair Value Gaps represent market inefficiencies that often, but not always, get filled. Use this indicator as part of a complete trading strategy rather than as a standalone system. The most valuable signals typically come from combining FVG analysis with other confirmatory indicators and overall market context. For optimal results, start with the default settings and gradually adjust parameters to match your specific trading timeframe and style.

Math by Thomas Order Blocks🔥 Description:

🚀 Math by Thomas Order Blocks is a precision tool for Smart Money Concept (SMC) and price action traders, designed to automatically detect Bullish and Bearish Order Blocks (OBs). It highlights key institutional trading zones where large orders are placed, helping you identify potential reversal and continuation areas.

⚙️ Key Features:

✅ Automatic Order Block Detection:

Detects Bearish OBs when price sharply reverses after a significant bullish move.

Identifies Bullish OBs following a sharp reversal from a bearish push.

✅ Dynamic Sensitivity & Volume Filter:

Sensitivity Control: Customize OB detection precision.

Minimum Volume Filter: Ensures OBs form only on significant volume spikes.

✅ Flexible OB Mitigation:

Choose between "Close" or "Wick" mitigation for OB invalidation.

Mitigated OBs are automatically removed from the chart.

✅ Adaptive Swing & Price Change Detection:

Adjusts OB detection logic based on timeframe for flexibility.

Uses adaptive rate of change (ROC) calculations to spot momentum shifts.

✅ Visual Customization:

OBs are displayed as shaded boxes with configurable background and border colors.

Bullish OBs = Green (support zones).

Bearish OBs = Red (resistance zones).

✅ Alerts for OB Touch:

Get real-time alerts when price touches a Bullish or Bearish OB.

Helps you catch potential reversal points without constant chart monitoring.

📊 How It Works:

Bullish OB Logic:

Detected when price crosses over a positive momentum threshold (ROC) with high volume.

Plots a green OB box from the low of the swing candle.

Bearish OB Logic:

Identified when price crosses under a negative momentum threshold with high volume.

Plots a red OB box from the high of the swing candle.

Mitigation Rules:

OBs are removed once invalidated by price action based on your chosen mitigation type (Close or Wick).

📈 Usage Tips:

Use Bullish OBs as potential support areas for buy entries.

Treat Bearish OBs as resistance zones for sell setups.

Combine with Fair Value Gaps, volume profile, and RSI for confluence.

Adjust sensitivity and volume filters to fine-tune OB detection.

✅ Chart Example:

The script displays:

Bullish OBs in green, marking potential support zones.

Bearish OBs in red, indicating resistance zones.

Real-time alerts when price touches OBs.

🔥 Why Use This Indicator?

Designed for intraday and swing traders aiming to identify institutional trading zones.

Helps you spot reversal and continuation setups with precision.

Ideal for Smart Money Concept (SMC), price action, and order flow traders.

Money Flow Oscillator [BullByte]

Overview :

The Money Flow Oscillator is a versatile technical analysis tool designed to provide traders with insights into market momentum through the Money Flow Index (MFI). By integrating trend logic, dynamic support/resistance levels, multi-timeframe analysis, and additional indicators like ADX and Choppiness, this script delivers a detailed view of market conditions and signal strength—all while adhering to TradingView’s publication guidelines.

Key Features :

Money Flow Analysis :

Uses the MFI to assess buying and selling pressure, helping traders gauge market momentum.

Trend Switch Logic :

Employs ATR-based calculations to determine trend direction. The background color adjusts dynamically to signal bullish or bearish conditions, and a prominent center line changes color to reflect the prevailing trend.

Dynamic Support/Resistance :

Calculates oscillator support and resistance over a pivot lookback period. These levels help you identify potential breakouts or reversals as the MFI moves above or below prior levels.

Signal Metrics & Classifications :

Combines MFI values with additional metrics to classify signals into categories such as “Strong Bullish,” “Bullish,” “Bearish,” or “Strong Bearish.” An accompanying note provides details on momentum entry and overall signal strength.

Multi-Timeframe Order Flow Confirmatio n:

Analyzes the MFI on a higher timeframe to confirm order flow. This extra layer of analysis helps verify the short-term signals generated on your primary chart.

Volume and ADX Integration :

Incorporates volume analysis and a manual ADX calculation to further validate signal strength and trend stability. A dashboard displays these metrics for quick reference.

Choppiness Indicator :

Includes a choppiness index to determine if the market is trending or choppy. When the market is identified as choppy, the script advises caution by adjusting the overall signal note.

Comprehensive Dashboard :

A built-in dashboard presents key metrics—including ADX, MFI, order flow, volume score, and support/resistance details—allowing you to quickly assess market conditions at a glance.

How to Use :

Trend Identification : Monitor the dynamic background and center line colors to recognize bullish or bearish market conditions.

Signal Confirmation : Use the oscillator support/resistance levels along with the signal classifications and dashboard data to make informed entry or exit decisions.

Multi-Timeframe Analysis : Validate short-term signals with the higher timeframe MFI order flow confirmation.

Risk Management : Always combine these insights with your own risk management strategy and further analysis.

Disclaimer :

This indicator is provided for educational and informational purposes only. It does not constitute financial advice. Always perform your own analysis and use proper risk management before making any trading decisions. Past performance is not indicative of future results.

EREMA SignalsOverview

The EREMA Signals indicator is a specialized overlay tool designed to display precise buy and sell signals directly on your price chart. Working as a companion to the main Ehlers Reverse EMA indicator, it brings powerful momentum-based signals to your trading strategy without cluttering your chart with additional indicator panels.

Key Features

On-Chart Signal Visualization: Clear buy/sell arrows appear directly on the price chart

Dynamic Signal Positioning: Signals automatically adjust their distance from price using ATR for optimal visibility

Multiple Signal Types: Choose from three distinct signal generation methods

Clean Chart Interface: Displays only the essential signals, maintaining chart clarity

Signal Types

Zero Cross: Generates signals when the Ehlers Reverse EMA crosses above/below the zero line

MA Cross: Identifies when the Ehlers Reverse EMA crosses its own moving average

Zero & MA Cross: The strictest filter, requiring both zero line and MA crossovers for signal generation

How To Use

Setup

First add the main "Ehlers Reverse EMA" indicator to your chart

Then add this "EREMA Signals" indicator as an overlay

Configure both indicators with identical settings for alpha, MA type, and signal method

Reading Signals

Green Triangles (below price): Buy signals indicating potential upward momentum

Red Triangles (above price): Sell signals indicating potential downward momentum

Trading Applications

Trend Identification: Zero cross signals help identify changes in overall trend direction

Momentum Trading: MA cross signals can identify shorter-term momentum shifts

Confirmation Tool: Use alongside other technical indicators or price action strategies

Multiple Timeframe Analysis: Apply to different timeframes for more robust trading decisions

Best Practices

Consider using longer timeframes (4H, Daily) for more reliable signals

The combined "Zero & MA Cross" setting provides fewer but higher-quality signals

For tighter entries, use the "MA Cross" option in established trends

Adjust the Alpha parameter to match your trading style (lower for longer-term, higher for shorter-term)

This indicator works seamlessly with the main Ehlers Reverse EMA indicator while maintaining a clean chart interface, making it ideal for traders who prefer visual simplicity without sacrificing analytical power.

Fibonacci Pivots [PQ_MOD]This comprehensive indicator calculates pivot points based on Fibonacci retracement and extension levels derived from historical price data. It dynamically computes a full suite of Fibonacci levels (e.g., 0, 0.236, 0.382, 0.5, 0.618, 1, 1.618, and others, including negative levels) using customizable deviation thresholds and depth settings across various timeframes, and then plots corresponding lines and labels on the chart. Additionally, the script integrates higher time frame OHLC analysis to enhance pivot determination and projects Fibonacci time zones by drawing vertical lines at intervals following the Fibonacci sequence. Optional add-ons incorporate volume and volatility measures to highlight potential exhaustion or high-volatility bars, while built-in alert functions notify users when key levels are crossed. Overall, this tool offers an advanced, multi-dimensional approach for identifying significant support, resistance, and trend reversal areas in market price action.