INVITE-ONLY SCRIPT

Quantoshi Global Liquidity Strategy

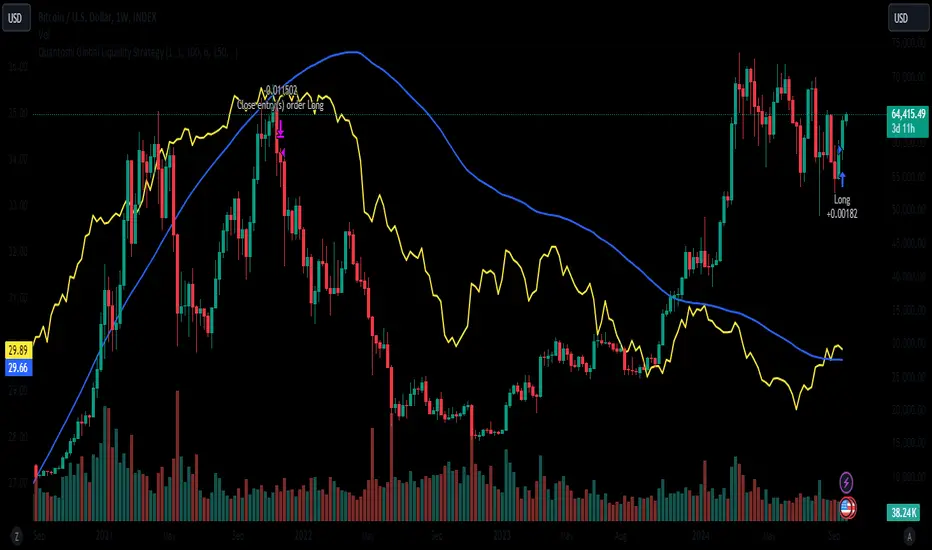

This strategy leverages global liquidity data alongside technical indicators like the Rate of Change (ROC) and Double Exponential Moving Average (DEMA) to identify optimal long-entry points during major market trends. The script is designed to capture long-term, sustained momentum and includes built-in risk management by filtering out rapid price spikes. It is best suited for swing trading or long-term trend trading.

Key Features:

Global Liquidity Data:

The strategy incorporates data from major global central banks and M2 money supply to calculate a comprehensive liquidity index, which is a critical component for long-term trend detection.

ROC-DEMA Crossover:

It combines the Rate of Change (ROC) and a 100-period Double Exponential Moving Average (DEMA) to identify momentum shifts. Long entries are triggered when these indicators confirm an upward trend.

Price Thresholds:

The strategy compares the current price to the price from several candles ago to ensure positions are not entered during unsustainable price surges.

Custom Alerts:

Automated alerts for long entries and exits allow users to automate their trades or receive timely notifications when market conditions are met.

How It Works:

The strategy enters long positions when ROC and DEMA signals confirm a positive trend, and the price conditions suggest a sustainable upward momentum. Long exits occur when the momentum reverses, with a clear crossover signal of ROC below DEMA. Custom alert messages make it ideal for automated trading setups.

Why It's Unique:

This strategy combines liquidity data with technical indicators to filter noise and focus on significant market shifts. It allows traders to capture major trend reversals without needing to actively monitor the charts, making it useful for those focused on swing or long-term trading.

Backtesting & Risk Management:

Given its long-term focus, this strategy generates only a few signals per decade when used on a weekly timescale. As a result, traditional backtesting show few trades, but historical analysis reveals its effectiveness in capturing major market movements.

Account Size:

The backtest is based on a $1,000 account size to represent a realistic trading scenario.

Commissions & Tick size: Commission fees of 0.1% and a tick size of 100 are applied to reflect real-world trading conditions.

Trade Size:

Risk per trade is limited to 5% of the account balance to align with sound risk management practices.

Key Features:

Global Liquidity Data:

The strategy incorporates data from major global central banks and M2 money supply to calculate a comprehensive liquidity index, which is a critical component for long-term trend detection.

ROC-DEMA Crossover:

It combines the Rate of Change (ROC) and a 100-period Double Exponential Moving Average (DEMA) to identify momentum shifts. Long entries are triggered when these indicators confirm an upward trend.

Price Thresholds:

The strategy compares the current price to the price from several candles ago to ensure positions are not entered during unsustainable price surges.

Custom Alerts:

Automated alerts for long entries and exits allow users to automate their trades or receive timely notifications when market conditions are met.

How It Works:

The strategy enters long positions when ROC and DEMA signals confirm a positive trend, and the price conditions suggest a sustainable upward momentum. Long exits occur when the momentum reverses, with a clear crossover signal of ROC below DEMA. Custom alert messages make it ideal for automated trading setups.

Why It's Unique:

This strategy combines liquidity data with technical indicators to filter noise and focus on significant market shifts. It allows traders to capture major trend reversals without needing to actively monitor the charts, making it useful for those focused on swing or long-term trading.

Backtesting & Risk Management:

Given its long-term focus, this strategy generates only a few signals per decade when used on a weekly timescale. As a result, traditional backtesting show few trades, but historical analysis reveals its effectiveness in capturing major market movements.

Account Size:

The backtest is based on a $1,000 account size to represent a realistic trading scenario.

Commissions & Tick size: Commission fees of 0.1% and a tick size of 100 are applied to reflect real-world trading conditions.

Trade Size:

Risk per trade is limited to 5% of the account balance to align with sound risk management practices.

Endast inbjudanskript.

Tillgången till detta skript är begränsat till användare som har godkänts av författaren och kräver vanligtvis betalning. Du kan lägga till det till dina favoriter men du kan bara använda det efter att ha begärt och fått författarens tillstånd. Contact Quantoshi for more information, or follow the author's instructions below.

TradingView does not suggest paying for a script and using it unless you 100% trust its author and understand how the script works. In many cases, you can find a good open-source alternative for free in our Community Scripts.

Vill du använda det här skriptet i ett diagram?

Warning: please read before requesting access.

Frånsägelse av ansvar

Informationen och publikationerna är inte avsedda att vara, och utgör inte heller finansiella, investerings-, handels- eller andra typer av råd eller rekommendationer som tillhandahålls eller stöds av TradingView. Läs mer i Användarvillkoren.