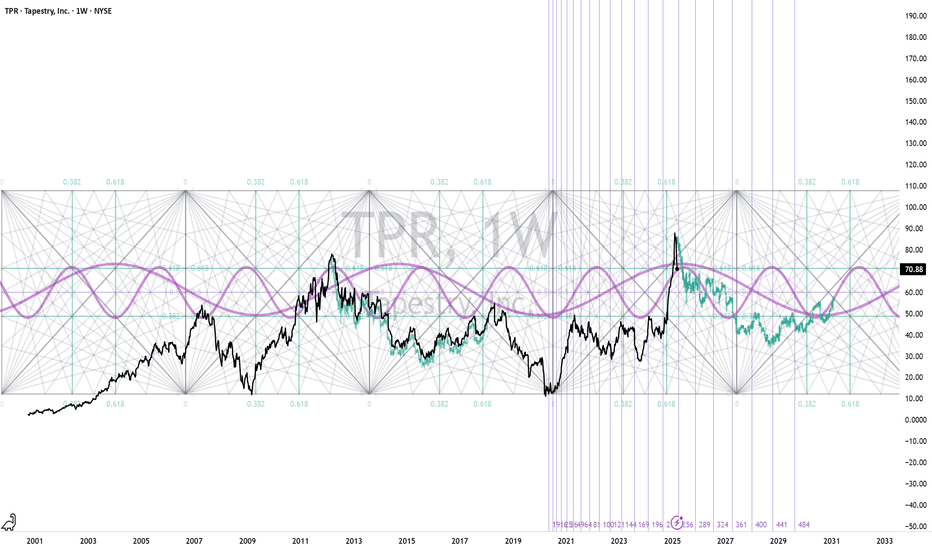

Tapestry Breaks Out of Consolidation, Eyes $100From 2021 through 2025, NYSE:TPR traded in a tight $25–$50 range, with both the 30- and 50-period EMAs running flat and volume largely sideways.

At the turn of 2025, however, the EMAs began to slope upward and volume picked up.

The first meaningful pullback since then saw price slide from $90

TAPESTRY INC COM USD0.01

77.2USDD

−2.0−2.50%

At close at May 23, 18:17 GMT

USD

No trades

Next report date

August 14

Report period

Q4 2025

EPS estimate

1.00 USD

Revenue estimate

1.67 B USD

3.8 USD

816.00 M USD

6.67 B USD

206.80 M

About Tapestry, Inc.

Sector

Industry

CEO

Joanne C. Crevoiserat

Website

Headquarters

New York

Founded

1941

FIGI

BBG00JRYB412

Tapestry, Inc. engages in the provision of luxury accessories and lifestyle brands. It operates through the following segments: Coach, Kate Spade, and Stuart Weitzman. The Coach segment consists of global sales of Coach brand products to customers through Coach operated stores, including the internet and concession shop-in-shops, and sales to wholesale customers, and through independent third-party distributors. The Kate Spade segment focuses on Kate Spade New York brand products to customers through Kate Spade operated stores, including the Internet, sales to wholesale customers, through concession shop-in-shops and through independent third-party distributors. The Stuart Weitzman segment includes Stuart Weitzman brand products primarily through Stuart Weitzman operated stores. The company was founded by Dawn Hughes in 1941 and is headquartered in New York, NY.

9.0%

10.5%

12.0%

13.5%

15.0%

Q3 '24

Q4 '24

Q1 '25

Q2 '25

Q3 '25

0.00

600.00 M

1.20 B

1.80 B

2.40 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

400.00 M

800.00 M

1.20 B

1.60 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

400.00 M

800.00 M

1.20 B

1.60 B

Q3 '24

Q4 '24

Q1 '25

Q2 '25

Q3 '25

0.00

2.50 B

5.00 B

7.50 B

10.00 B

Debt

Free cash flow

Cash & equivalents

No news here

Looks like there's nothing to report right now

Insanely on watch for 60 and the indicators set upI can't believe how bullish this is based on the volume indicator box, distribution, consolidation, earnings upcoming, breakthrough catalyst upcoming, stochastic and rsi heading on up, and macd crossing over, with other confirmations. I would probably wait to see a pullback and then get in until the

NLong

Tapestry Squeezes Before Retail SalesTapestry had a big rally in the first quarter and has been consolidating since. Now some traders may see potential for a move to the upside.

The first pattern on today’s chart is the January low of $35.26. The retailer tested and held that level in early August, which may suggest that support is in

NShort

👜💼 Tapestry (TPR) - Amazon Deal and Growth Strategies! 📈💡📊 Analysis:

Amazon Deal: Tapestry's groundbreaking deal with Amazon to sell Coach bags.

Acquisition: Planned acquisition of Capri Holdings for $8.5 billion.

Revenue Growth: Record revenue and anticipated stable long-term growth.

📈 Bullish Sentiment:

Entry: Suggested entry above the $39.00-$40.00 ra

NLong

Swing Trading Signals, Momentum Patterns: TPRLuxury fashion brands are popular for speculation heading into the holidays.

With a few points to the bottom completion resistance, NYSE:TPR has a swing trading entry signal, 2 in a row now. Resting days that create a narrow consolidation can be powerful momentum-building patterns for short-term

NLong

Tapestry Inc Inverted H&STapestry Inc is testing the neckline of an inverted head and should pattern with price above all MAs(8,21,34,50,100,200) and all MAs in bullish order. This indicates a bullish price trend.

The lower PPO indicator show the green PPO line rising and above the purple signal line indicating short-term

NLong

$TPRNYSE:TPR breaking above falling resistance line. Will continue to see how this closes above trend, and possibly makes a short-term retest before moving higher.

NLong

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TPR5955173

Tapestry, Inc. 5.5% 11-MAR-2035Yield to maturity

6.00%

Maturity date

Mar 11, 2035

TPR5303776

Tapestry, Inc. 3.05% 15-MAR-2032Yield to maturity

5.76%

Maturity date

Mar 15, 2032

TPR5955472

Tapestry, Inc. 5.1% 11-MAR-2030Yield to maturity

5.30%

Maturity date

Mar 11, 2030

COH4504624

Tapestry, Inc. 4.125% 15-JUL-2027Yield to maturity

4.82%

Maturity date

Jul 15, 2027

See all 0LD5 bonds

Curated watchlists where 0LD5 is featured.

Frequently Asked Questions

The current price of 0LD5 is 77.2 USD — it has decreased by −2.50% in the past 24 hours. Watch TAPESTRY INC COM USD0.01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange TAPESTRY INC COM USD0.01 stocks are traded under the ticker 0LD5.

0LD5 stock has fallen by −7.67% compared to the previous week, the month change is a 13.80% rise, over the last year TAPESTRY INC COM USD0.01 has showed a 86.54% increase.

We've gathered analysts' opinions on TAPESTRY INC COM USD0.01 future price: according to them, 0LD5 price has a max estimate of 110.00 USD and a min estimate of 73.00 USD. Watch 0LD5 chart and read a more detailed TAPESTRY INC COM USD0.01 stock forecast: see what analysts think of TAPESTRY INC COM USD0.01 and suggest that you do with its stocks.

0LD5 reached its all-time high on Feb 18, 2025 with the price of 90.6 USD, and its all-time low was 10.8 USD and was reached on Apr 3, 2020. View more price dynamics on 0LD5 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0LD5 stock is 3.95% volatile and has beta coefficient of 1.17. Track TAPESTRY INC COM USD0.01 stock price on the chart and check out the list of the most volatile stocks — is TAPESTRY INC COM USD0.01 there?

Today TAPESTRY INC COM USD0.01 has the market capitalization of 16.41 B, it has increased by 11.84% over the last week.

Yes, you can track TAPESTRY INC COM USD0.01 financials in yearly and quarterly reports right on TradingView.

TAPESTRY INC COM USD0.01 is going to release the next earnings report on Aug 14, 2025. Keep track of upcoming events with our Earnings Calendar.

0LD5 earnings for the last quarter are 1.03 USD per share, whereas the estimation was 0.88 USD resulting in a 17.15% surprise. The estimated earnings for the next quarter are 1.00 USD per share. See more details about TAPESTRY INC COM USD0.01 earnings.

TAPESTRY INC COM USD0.01 revenue for the last quarter amounts to 1.58 B USD, despite the estimated figure of 1.53 B USD. In the next quarter, revenue is expected to reach 1.67 B USD.

0LD5 net income for the last quarter is 203.30 M USD, while the quarter before that showed 310.40 M USD of net income which accounts for −34.50% change. Track more TAPESTRY INC COM USD0.01 financial stats to get the full picture.

Yes, 0LD5 dividends are paid quarterly. The last dividend per share was 0.35 USD. As of today, Dividend Yield (TTM)% is 1.77%. Tracking TAPESTRY INC COM USD0.01 dividends might help you take more informed decisions.

TAPESTRY INC COM USD0.01 dividend yield was 3.27% in 2024, and payout ratio reached 40.01%. The year before the numbers were 2.80% and 30.94% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of May 24, 2025, the company has 18.6 K employees. See our rating of the largest employees — is TAPESTRY INC COM USD0.01 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TAPESTRY INC COM USD0.01 EBITDA is 1.63 B USD, and current EBITDA margin is 23.23%. See more stats in TAPESTRY INC COM USD0.01 financial statements.

Like other stocks, 0LD5 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TAPESTRY INC COM USD0.01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TAPESTRY INC COM USD0.01 technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TAPESTRY INC COM USD0.01 stock shows the buy signal. See more of TAPESTRY INC COM USD0.01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.