Indikatorer, strategier och bibliotek

Hi Traders ! Introduction: I have recently been exploring the world of automated algorithmic trading (as I prefer more objective trading strategies over subjective technical analysis (TA)) and would like to share one of my automation compatible (PineConnecter compatible) scripts “Session Breakout Scalper”. The strategy is really simple and is based on time...

This is a highly-customizable trading strategy made by TradeSmart, focusing mainly on ATR-based indicators and filters. The strategy is mainly intended for trading forex , and has been optimized using the Deep Backtest feature on the 2018.01.01 - 2023.06.01 interval on the EUR/USD (FXCM) 15M chart, with a Slippage value of 3, and a Commission set to 0.00004 USD...

This is a simple strategy that is working well on SPY but also well performing on Mini Futures SP500. The strategy is composed by the followin rules: 1. If RSI(2) is less than 15, then enter at the close. 2. Exit on close if today’s close is higher than yesterday’s high. If you backtest it on Mini Futures SP500 you will be able to track data from 1993. It is...

This is a simple strategy that is working well on SPY but also well performing on Mini Futures SP500. The strategy is composed by the followin rules: 1. If today’s close is below yesterday’s five-day low, go long at the close. 2. Sell at the close when the two-day RSI closes above 50. 3. There is a time stop of five days if the sell criterium is not...

This is a simple strategy that is working well on SPY but also well performing on Mini Futures SP500. The strategy is composed by the followin rules: 1. Today is Monday. 2. The close must be lower than the close on Friday. 3. The IBS must be below 0.5. 4. If 1-3 are true, then enter at the close. 5. Sell 5 trading days later (at the close). If you backtest it on...

The new "Pure Morning 2.0 - Candlestick Pattern Doji Strategy" is a trend-following, intraday cryptocurrency trading system authored by devil_machine. The system identifies Doji and Morning Doji Star candlestick formations above the EMA60 as entry points for long trades. For best results we recommend to use on 15-minute, 30-minute, or 1-hour timeframes, and are...

Yesterday’s High Breakout it is a trading system based on the analysis of yesterday's highs, it works in trend-following mode therefore it opens a long position at the breakout of yesterday's highs even if they occur several times in one day. There are several methods for exiting a trade, each with its own unique strategy. The first method involves setting...

OVERVIEW: This Risk Reward Calculator strategy can help you maximize your RR value with help of algorithmic trading. INDICATOR: I wanted to setup my trades more easier with this indicator, I didn't want to calculate everytime before orders, with help this indicator we can calculate R:R value, avarage price, stoploss price, take-profit price, order...

OVERVIEW: This Grid trading strategy can help you maximize your profit in a ranging sideways market with no clear direction. INDICATOR: We can get some money by taking advantage of the movement of the price between the range we have determined. Short positions are opened while the price is rising, long positions are opened while the price is...

Stop worrying about catching the lowest price, it's almost impossible!: with this trend-following strategy and protection from bearish phases, you will know how to enter the market properly to obtain benefits in the long term. Backtesting context: 1899-11-01 to 2023-02-16 of SPX by Tvc. Commissions: 0.05% for each entry, 0.05% for each exit. Risk per trade:...

This is my first attempt at a trading script using the RSI indicator for Buy & Sell signals (so please be nice but would appreciate any constructive comments). Starting with $100 initial capital and using 10% per trade You can select which month the backtesting starts There is also a monthly table (sorry can’t remember who I got this from) that shows the total...

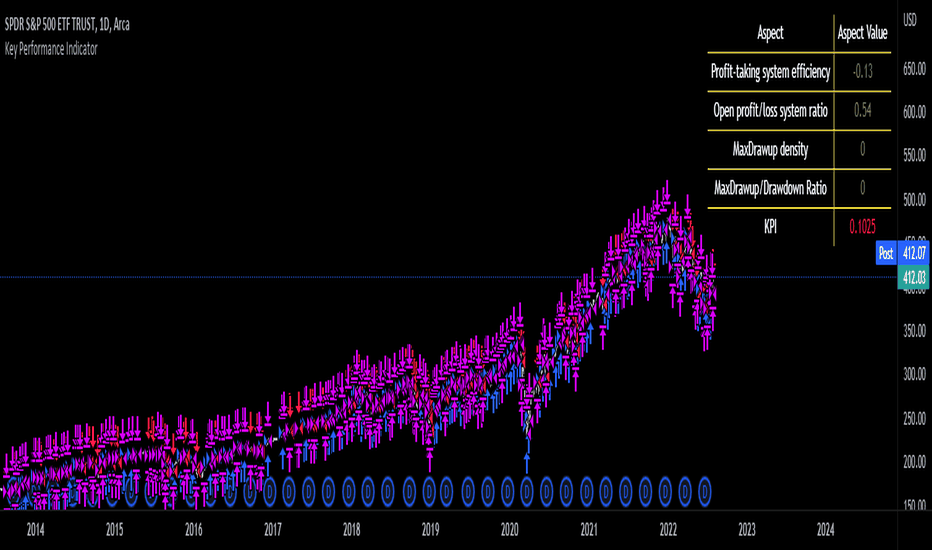

We are happy to introduce the Key Performance Indicator by Detlev Matthes. This is an amazing tool to quantify the efficiency of a trading system and identify potential spots of improvement. Abstract A key performance indicator with high explanatory value for the quality of trading systems is introduced. Quality is expressed as an indicator and comprises the...

"Please give us combined alerts with the possibility of having several conditions in place to trigger the alert." - was the top voted request from users under one of the recent blogposts by TradingView. Ask and you shall receive ;) TradingView is a great platform, with unmatched set of functionalities, yet this particular combo of features indeed seems not to be...

this script is upgraded version of previous one the major change is deleted script which find a highest price after entry the last of strategy is same. If current volume is above daily average volume, and three bollinger band`s Standard Deviation, 1 and 1.5 and 2 if the current lowest price is bigger then 1 stdev and current closed is bigger then 1.5 stdev and the...

This script consist of two parts: linear SSL and DEMA. The difference between original SSL and current is that it calculated by linear regression. The logic is simple: when SSL "crossunder" and DEMA is above the price - we get short signal. When price became above DEMA and SSL "crossover" - close short.

Software part of algotrading is simpler than you think. TradingView is a great place to do this actually. To present it, I'm publishing each of the default strategies you can find in Pinescript editor's "built-in" list with slight modification - I'm only adding 2 lines of code, which will trigger alerts, ready to be forwarded to your broker via TradingConnector...

Software part of algotrading is simpler than you think. TradingView is a great place to do this actually. To present it, I'm publishing each of the default strategies you can find in Pinescript editor's "built-in" list with slight modification - I'm only adding 2 lines of code, which will trigger alerts, ready to be forwarded to your broker via TradingConnector...

DMI (Directional Movement Index) and HMA (Hull Moving Average) The DMI and HMA make a great combination, The DMI will gauge the market direction, while the HMA will add confirmation to the trend strength. What is the DMI? The DMI is an indicator that was developed by J. Welles Wilder in 1978. The Indicator was designed to identify in which direction the price...

![Risk Reward Calculator [lovealgotrading] BTCUSDT.P: Risk Reward Calculator [lovealgotrading]](https://s3.tradingview.com/g/GbgkGI2h_mid.png)

![AUTOMATIC GRID BOT STRATEGY [ilovealgotrading] AVAXUSDT.P: AUTOMATIC GRID BOT STRATEGY [ilovealgotrading]](https://s3.tradingview.com/6/6qZpzElZ_mid.png)